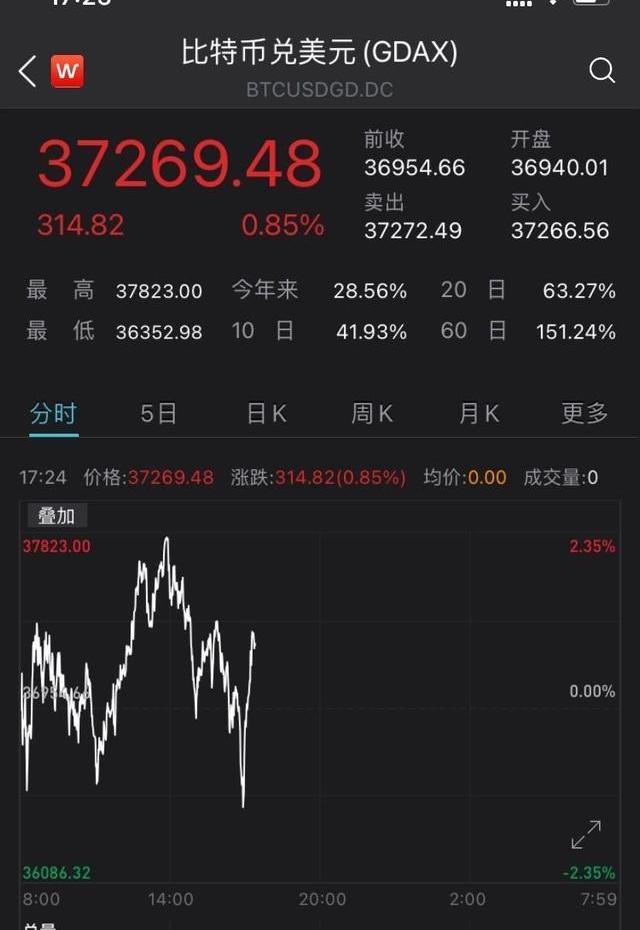

北京商报讯自突破20000美元关口后,比特币价格走上快速上升的高速道,最高交易价格持续刷新。Wind数据显示,1月7日,比特币价格最高突破37800美元,截至17时25分报37269.48美元,日内涨幅0.85%。今年的7个交易日,比特币涨幅近29%,60个交易日内,涨幅超过151%。

The Beijing Business Press reported that Bitcoin prices have been on a fast-growing high-speed path since the US$ 20,000 threshold. Wind figures show that on 7 January, Bitcoin prices peaked by $37,800, up by $37,269.48 as at 1725, with an increase of 0.85 per cent. This year's seven trading days saw an increase of almost 29 per cent in bitcoins and more than 151 per cent in 60 trading days.

除了比特币之外,据比特币家园数据统计,截至发稿之时,市值排名前10的虚拟货币中,仅有泰达币24小时交易价格处于平稳状态,以太坊24小时涨幅超8%,波场币24小时涨幅超32%。从市场份额来看,当前比特币市场占有率为67.60%,以太坊市场占有率为13.41%,泰达币市场占有率为2.22%。

With the exception of Bitcoin, according to Bitcoin Home Office statistics, at the time of publication, only 20 of the first 10 virtual currencies with market value were in a stable 24-hour trade price, with a 24-hour increase of more than 8% and a 24-hour increase of more than 32% in Taiku. In terms of market share, the market is currently 67.60% in Bitcoin, 13.41% in Tedarco and 2.22% in Tedarco.

除了带动虚拟货币交易行情外,比特币价格上涨也促使了港股区块链概念股股价上涨。截至港股1月7日收盘,港股区块链概念板块收涨5.53%,火币科技收涨6.69%,欧科云链收涨10.53%,雄岸科技收涨69.44%。

In addition to driving virtual currency transactions, the price increase in Bitcoin has contributed to an increase in the stock price of the Hong Kong stock chain concept. As of January 7, the Hong Kong stock chain concept was closed, with a 5.53 per cent increase in the Hong Kong stock chain, a 6.69 per cent increase in gunship technology, a 10.53 per cent increase in the Oco-Yun chain and a 69.44 per cent increase in male bank technology.

“市场的狂热和全球央行放水,同时也助推了比特币、以太坊等加密货币资产的暴涨暴跌。”

“Market fanaticism and the release of global central banks have also contributed to the surge and collapse of encrypted monetary assets such as Bitcoin, Etheria and others.”

上海对外经贸大学人工智能与变革管理研究院区块链技术与应用研究中心主任刘峰告诉北京商报记者,比特币价格新一轮上涨的逻辑与以前上涨不同的地方主要在于两方面,一方面在于自从比特币价格突破2万美元,解套了前一轮高位接盘的用户,给市场带来创新高没有历史包袱的错觉;另一方面是机构投资者持续的入局,让市场投资者们信心大涨。

Liu Feng, Director of the Centre for Block Chain Technology and Applied Research at the Institute of Artificial Intelligence and Change Management at Shanghai Foreign Economic and Trade University, told the Beijing Business Journal that the logic of the new price increase in Bitcoin was different from the previous one in two ways, on the one hand, since the price of Bitcoin passed by $20,000, dissipating users of the previous round of high-level connections, giving the market the illusion that innovation was high without historical burden; and, on the other hand, the continued entry of institutional investors, giving market investors confidence.

不过,北京商报记者注意到,尽管自突破20000美元关口后,比特币价格整体呈快速上涨趋势,但期间也出现了短期内大幅下跌,依旧处于大幅度的波动之中。1月4日,比特币日内短线急速下挫,跌幅最高超过14%,浮动金额超过4000美元。

However, Beijing Business Reporters noted that despite the overall rapid upward trend in Bitcoin prices since the break-up of the US$200, the period was also characterized by a sharp short-term decline, which remained volatile. On 4 January, the short line in Bitcoin fell at a sharp rate of more than 14%, with a floating value of more than US$4,000.

比特币价格的大幅波动,也提高了爆仓风险。据比特币家园数据统计,1月4日,全网合约市场多单爆仓、空单爆仓合计金额为13.26亿美元,约合人民币85.64亿元。截至发稿24小时内,共有82404人爆仓,全网合约市场爆仓金额5.43亿美元,约合人民币35亿元。其中,比特币24小时内爆仓2.91亿美元,约合人民币18.81亿元。

According to Bitcoin Home Data, a total of $1,326 million was spent on multi-silo and empty silos in the entire Internet contract market on 4 January, amounting to approximately $8,564 million. As of 24 hours of issuance, 82,04 people had exploded, with $543 million and $3.5 billion in the fulls contract market. Of that amount, $291 million and about $1,881 million were destroyed in Bitcoin within 24 hours.

刘峰指出,比特币价格出现大幅度下跌,除了暴涨后的技术性回调外,另一个原因在于市场上信心大增的是长期投资用户,而被爆仓的则是比特币等加密资产在整数位突破不了,开多倍合约对下跌做空的投机用户们。往往在突破整数位关口、创新高的时候存在着极大的波动,对投机者爆仓的几率也急剧增加。

Liu Feng pointed out that the price of bitcoin had fallen sharply, and that, in addition to the technical rebound after the surge, it was the long-term investors who had increased their confidence in the market, and the cryptic assets such as bitcoin, who could not break through the whole number, and the speculative users who had made multiple contracts to empty the fall. There was often a great deal of volatility at the time the inch was broken and the innovation was high, and there was a sharp increase in the chances of blowing up the speculator’s speculators.

“比特币价格疯狂的上涨一定蕴涵了巨大的泡沫,作为普通投资者需要有所警惕。”刘峰表示,比特币上涨的背后,不仅存在大量合约投机者爆仓的风险,还存在着币市的规模急剧增大,违法活动也更有空间等情况,比如变相、反恐怖主义融资等违法行为。

“The insane increase in the price of Bitcoin must have implied a huge bubble that requires vigilance as an ordinary investor.” Liu Feng states that behind the rise of Bitcoin there is not only a risk that large numbers of contract speculators will bust, but also a dramatic increase in the size of the currency market and greater scope for illegal activities, such as disguised offences, anti-terrorist financing, etc.

刘峰强调,目前币圈市场上各种投资群、山寨币、币又开始频繁的活动,很容易导致没有这方面知识储备投资者财产损失,甚至遭受法律风险。一方面监管部门要加强监管,保护好合法投资者的财产安全,持续打击非法活动。另一方面普通投资者自身要做好相关知识学习,赚认知之内的钱,同时还要有一定的法律保护意识,加强自身风险抵抗能力。

Liu Feng stressed that the current boom in the currency market, which is characterized by a variety of investments, bounties, and currency activity, can easily lead to loss of property and even legal risks for investors without such knowledge. On the one hand, regulatory authorities need to strengthen regulation, protect the property of legitimate investors, and continue to combat illegal activity.

标签:比特币价格比特币IFT区块链比特币价格行情怎么样穿越回2009年怎么买比特币IFTI国内最好的区块链公司

Label: bitcoin price

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论