来源:上海律协(本文系作者投稿)

Source: Shanghai Bar Association (author's contribution)

作者:刘婧 上海瀛东律师事务所

Author: Liu Xing, Shanghai Xiaodong Law Firm

· 欢迎大家踊跃留言,分享交流各自观点 ·

• Welcome to your comments and share your views

· 此文系作者个人观点,不代表上海市律师协会立场 ·

• The author's personal opinion does not represent the position of the Shanghai City Bar Association

一、概述

I. OVERVIEW

(一)

(i)

资产证券化

Securitization of assets

资产证券化(Asset-backedSecurities,简称“ABS”)一般是指将缺乏流动性,但具有稳定可预期收入的资产,通过在资本市场上发行证券的方式出售,从而帮助资产持有者获得融资。

Securitization of assets (Asset-backedSecurities) generally refers to assets that will lack liquidity but have a stable and predictable income and are sold through the issuance of securities on the capital market, thus helping asset holders to obtain financing.

ABS的应用领域十分广泛,尤其受到制造业和金融业的青睐。一方面,基于生产周期长、固定投资量大的行业特性,制造业企业对于高投资回报率的需求更为迫切。ABS能够帮助制造业企业最大限度地利用资产,提高生产效率。另一方面,由于可以在货币市场上通过发行证券的方式直接融资,有效解决银行资金短存长贷之间的问题,ABS一直以来都作为资本市场抢手产品,受到各类金融机构的追捧。

On the one hand, the need for high returns on investment is even more pressing for manufacturing firms, based on the industry characteristics of long production cycles and high fixed investment volumes. ABS can help manufacturing enterprises to maximize the use of assets and improve production efficiency.

然而,在目前阶段ABS的现实操作中,仍面临着一个巨大的技术挑战,即如何精确评估资产风险,并动态管理风险。

However, at this stage of ABS practical operations, there is still an enormous technical challenge, namely, how to accurately assess asset risks and manage them dynamically.

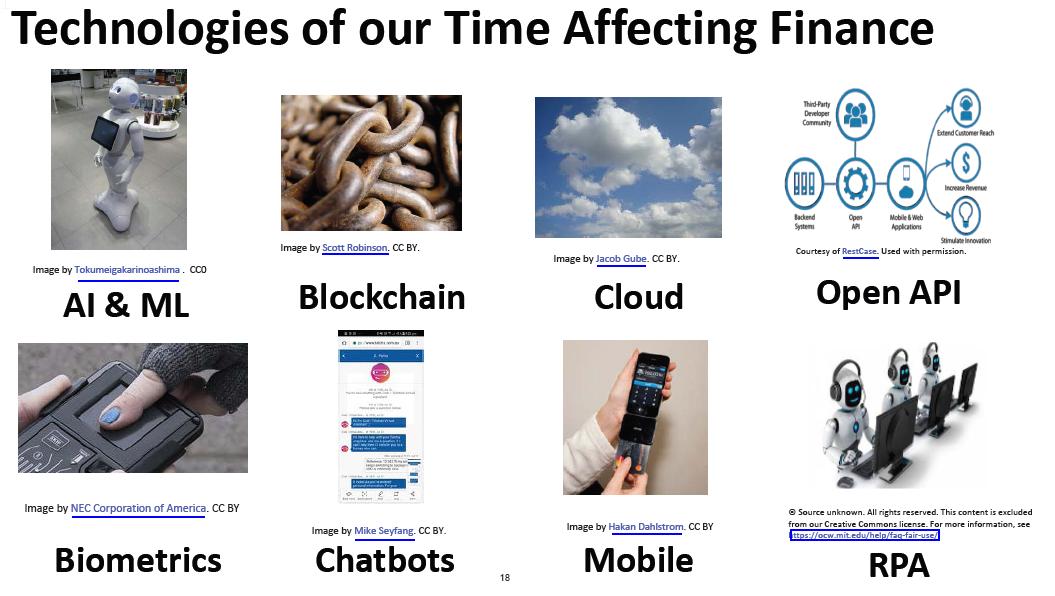

通常的保守操作是采用主体评级方法,但这样的方法往往更有利于国资背景企业和身处稳定行业中的大型企业,对于特别在COVID-19疫情之后亟需金融支持的中小型企业或创新型企业,往往并不友好。这种情况下,能够实现主体评级和债项评级相分离的现代金融科技(Fintech,具体分类见图一)为精细化评估ABS风险提供了更优选择,特别是若能充分挖掘利用区块链技术,则将为ABS的架构设计及发展提供巨大支持。

The usual conservative approach is to adopt a master rating approach, but such an approach is often more favourable for firms with a national background and large firms in stable industries, and is often unfriendly for small and medium-sized enterprises or innovative enterprises that need financial support, especially in the wake of the COVID-19 epidemic. In such cases, modern financial technology (Fintech, specifically classified in figure I) that allows for the separation of master and debt ratings provides better options for fine-tuning the assessment of ABS risks, especially if the use of block chain technologies is fully exploited, which will provide significant support for the design and development of ABS architecture.

图一现代金融科技1

Figure I Modern financial technology1

(二)

(ii)

区块链技术

Block Chain Technology

所谓区块链技术,本质上是一种数据存储和验证的技术,具有开放性、不可篡改、可以重复检验、匿名以及分布式的特点,利用该技术能实现有效保密存储、信息不可篡改等目标。

The so-called block chain technology is essentially a data storage and validation technology that is open, non-manufacturing, re-testable, anonymous and distributed, and is used to achieve the objectives of effective and confidential storage and non-diversion of information.

自2016年12月“区块链”首次被作为战略性前沿技术写入国务院“十三五”国家信息化规划2以来,国家积极出台政策推动区块链产业和应用发展;2019年1月,国家互联网信息办公室发布《区块链信息服务管理规定》3,为区块链信息服务提供有效的法规依据,此后对区块链的监管日趋成熟;2019年10月,习近平总书记在中共中央政治局第十八次集体学习中指出,要把区块链作为核心技术自主创新重要突破口,将区块链技术上升为国家战略。近些年,区块链技术的研究与应用在国家政策支持下近年来得到了飞速发展。

Since December 2016, when the block chain was first included as a strategic front-line technology in the State Council's 13th Five-Year National Information Plan,2 the State has actively promoted the development of the block chain industry and application; in January 2019, the National Internet Information Office issued the Regulation on the Management of Block Chain Information Services,3 which provides an effective regulatory basis for block chain information services, and since then has become more sophisticated in the regulation of the block chain; in October 2019, the General Secretary of Xi Jinping, in the eighteenth collective study of the Central Political Bureau of the Central China Republic, noted the need to make the block chain an important entry point for core technological autonomy and to upgrade the block chain technology to a national strategy.

二、制造业供应链ABS中

ii. ABS in the manufacturing supply chain

区块链应用的选择与评估

Selection and evaluation of block chain applications

合适的技术利用及结构设计不能脱离行业背景和行业实践,针对制造业企业的ABS和区块链技术应用更需要针对其行业特性做具体化设计。下文将从数据管理权限、评估数据来源、数据使用方案三个方面对具体化设计方案进行分析比对。

Appropriate technology use and structural design cannot be divorced from industry context and industry practice, and the ABS and block chain technology applications for manufacturing enterprises need to be more specific to their industry characteristics. An analysis of the specific design options will be done next in terms of data management competencies, assessment of data sources, and data use options.

(一)

(i)

数据管理权限:许可区块链vs无许可区块链

Access to data management: licence block chain vs non-licensed block chain

1.概念解析

1. Conceptual resolution

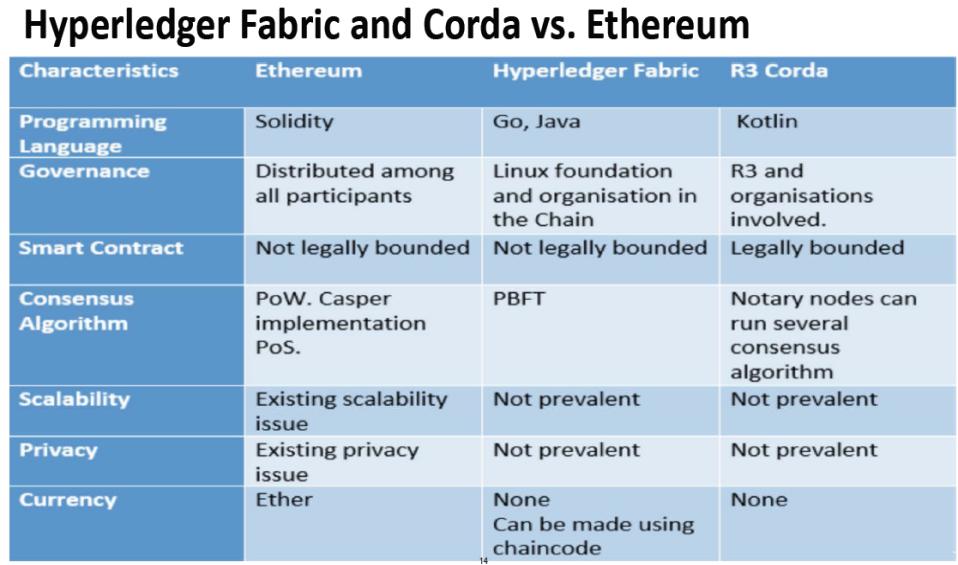

目前,市场上无数的创业企业都在积极开发新的区块链技术,其中占主导地位的主要是以太坊技术(Ethereum),开源分布式账本技术(Hyperledger Fabric)以及基于金融合约的分布式账本技术(R3Corda)三种区块链技术体系。针对这三种技术体系的详细技术参数比较可参见图二。

At present, numerous start-ups in the market are actively developing new block chain technologies, dominated by etheeum, the Open Source Distributed Books (Hyperledger Fabric) and the Financial Contract-based Distributed Books Technology (R3Corda). The detailed technical parameters for these three technological systems can be found in figure II.

根据是否需要许可才能读取链上数据,可将区块链分为许可区块链和无许可区块链(即公链)。

Depending on the need for permission to read the data on the chain, the block chain can be divided into a chain of licensed and unlicensed blocks (i.e. a public chain).

对于无许可区块链(Permissionless blockchain),基本上任何人都能读取,因此一般会通过代币机制进行认证激励。在区块链系统当中,因为没有中心化记账机构,为保证每一输入记录在所有记账节点上的一致性,必须要设计一个共识机制——工作量证明机制(Proof-of-Work)来解决一致性问题。工作量证明机制要求用户进行一些耗时的复杂运算进行认证,并以耗用的设备、能源成本作为担保,形成共识,因此需要设计代币或者虚拟货币来鼓励参与者确认信息的准确性,从而确保数据的一致性和安全性。比特币、以太坊都是典型的应用。

In the block chain system, since there is no central accounting institution, a consensus mechanism — the Proof-of-Work — has to be designed to address the issue of consistency. The workload proof mechanism requires users to perform a number of time-consuming and complex calculations to authenticate and create a consensus based on the cost of consuming equipment, energy, thus requiring the design of a proxy or virtual currency to encourage participants to confirm the accuracy of the information so as to ensure consistency and security of the data. Bitcoins and Taichak are typical applications.

而对于许可区块链(Permissioned blockchains),需要经运营主体许可设立节点方能进行交易验证,因此一般无需代币机制进行共识认证,Hyperledger Fabric 和R3Cord 技术体系即在此列。

In the case of the licensed block chain, nodes are required to be established with the permission of the operator to verify the transaction, so that there is generally no need for consensus certification of the token mechanism, as in the case of the Hyperledger Fabric and R3Cord technical systems.

图二 区块链技术比较4

Figure II Technical comparison of block chains4

2.法律适用与监管风险

2. Application of the law and regulatory risks

从法律的管辖与适用来看,无许可区块链去中心化的技术革新与金字塔形的法律体系监管存在着巨大矛盾。由于任何节点不存在许可机制,且其节点在定义上也没有具体的物理地址,因此在法律适用上存在很大争议;对比而言,由于许可区块链主要节点的物理位置可确认的特征,一定程度上可以降低法律适用的不确定性。

In terms of the jurisdiction and application of the law, there is a great contradiction between the technological innovation of centralizing the non-licensed block chain and the regulation of the pyramid-shaped legal system. Since there is no licensing mechanism at any node and its node does not have a specific physical address by definition, there is considerable controversy about the application of the law; by contrast, the physical location of the main node of the licence block chain may, to some extent, reduce uncertainty about the application of the law.

从近年中国的监管来看,对于代币、虚拟货币主要采取高压政策,严监管态度。2018年8月,中国银行保险监督管理委员、中央网络安全和信息化委员会办公室、公安部、中国人民银行、国家市场监督管理总局发布《关于防范以“虚拟货币”“区块链”名义进行非法集资的风险提示》5,强调一些不法分子打着“金融创新”“区块链”的旗号,通过发行所谓“虚拟货币”“虚拟资产”“数字资产”等方式吸收资金,侵害公众合法权益。将此类活动定性为并非真正基于区块链技术,而是炒作区块链概念进行非法集资、传销、诈骗。2019年1月,国家互联网信息办公室发布《区块链信息服务管理规定》6,强调区块链信息服务提供者和使用者不得利用区块链信息服务从事危害国家安全、扰乱社会秩序、侵犯他人合法权益等法律行政法规禁止的活动。鉴于上述规定,对于无许可区块链中用于激励认证的代币都需要明确适用范围,否则可能存在被认定为非法集资的监管风险。

In August 2018, the China Banking Insurance Supervisory Board, the Central Committee for Cybersecurity and Informatization, the Ministry of Public Security, the People's Bank of China, and the General Directorate of State Market Supervision issued the “Risk Notices on Protection against the Risk of Illegal Fund-raising in the name of the “block chain” of the “virtual currency”,5 under the banner of the “fiscal innovation” of the “block chain” and the absorption of funds against the legitimate rights and interests of the public by issuing the so-called “virtual” “digital assets” of the Chinese Bank Insurance Supervisory Board, the Central Network Security and Informatization Committee, the Ministry of Public Security, the People's Bank of China, and the General Directorate of State Market Supervision. In January 2019, the National Internet Information Office issued the Regulation on the Management of the District Chain Information Services,6 stressing that service providers and users of the sector chains should not use information services to undermine national security, disrupt social order, and violate the legitimate rights and interests of others.

因此从法律风险的管控来看,支持许可的Hyperledger Fabric 和R3Cord 技术体系更具备适用性和安全性。

Thus, the technical systems supporting the licensed Hyperleder Fabric and R3Cord are more applicable and safe from the control of legal risks.

3.区块链应用的可操作性

Operationality of block chain applications

将许可区块链技术应用于制造业企业ABS是具备较高可行性的。

The application of licensed block chain technology to manufacturing enterprise ABS is highly feasible.

制造业交易环节多、流程复杂、透明度差,针对制造企业某一具体交易的普通审计都需要耗费大量人力和时间。而应用许可区块链技术后,由于整个流程中的参与企业是具体可确定的,因此可以设置有许可限制的节点,辅以其他机制进行网络信息的一致性认证,从而避免大量的计算损耗,达到数据共识。比如由一个行业内主要生产商设立几个主节点,或者行业平台设立一个或者多个主节点,参与的上下游企业成为参与节点,通过使用拜占庭容错算法(Practical Byzantine FaultTolerance,PBFT)7,即可达成区块链共识。而在这一过程中,由于节点确定和许可机制,较大程度地降低了法律适用及监管风险。

Manufacturing transactions are numerous, complex, and poorly transparent, and ordinary audits of a particular transaction by a manufacturing enterprise require considerable effort and time. The application of licensing block chain technology, as participating enterprises in the entire process are specific and identifiable, allows for the creation of licensed nodes, supported by other mechanisms for the consistent authentication of network information, to avoid significant computational losses and to reach a consensus on data. For example, a few main nodes are set up by a major producer within the industry, or one or more main nodes are established by an industry platform, with the participation of upstream or downstream enterprises becoming a node for participation, leading to a regional node consensus through the use of the Byzantical Byzantine Fishery, PBFT. In this process, by identifying and licensing mechanisms, legal application and regulatory risks are significantly reduced.

(二)

(ii)

评估数据来源:关系型数据库vs分布式数据库

Assessment of data sources: relationship database vs distributed database

1.关系型数据库及其问题

1. Relationship-type databases and their issues

制造商进行交易,有实物商品的交换,而如何把商业交换记录在案,并进行管理,便是财务会计学科的主要任务。传统的会计学要求格式化的输入,对应的信息技术是关系型数据库(Relational Database),在数据映射关系上,制造业企业的底层数据通过财务报表和企业资源管理系统(ERP)收集上来。

The primary task of the financial accounting discipline is for manufacturers to trade, exchange goods in kind, and how to record and manage business exchanges. Traditional accounting requires formatting input, corresponding to the information technology Relational Data, where bottom-level data from manufacturing enterprises are collected through financial statements and enterprise resource management systems (ERPs).

然而,关系型数据库并未有效解决底层数据准确性和资产监控问题。对数据准确性的保证仍然依赖会计学科技术,比如复式记账法;对于企业具体资产的监控,也仍然依赖于传统的审计原则,比如需要具体的人员去审计一个制造企业是否执行了“先进先出”(FIFO)或者“后进先出”(LIFO)的库存管理方法,从而对企业的财务报表数字进行查验。

The relationship-based database does not, however, effectively address bottom-level data accuracy and asset monitoring. The assurance of data accuracy remains dependent on accounting discipline techniques, such as double-entry; and on traditional audit principles, such as requiring specific personnel to audit whether a manufacturing enterprise has implemented “first-in-first-out” (FIFO) or “first-in-out” (LIFO) inventory management methods to verify the financial statement figures of an enterprise.

因为缺乏有效监管,能够手工操作篡改的的会计账簿一直被包括公众公司在内的各家企业的会计专业人员按需调校。以税务局监管为中心的金税工程第四期系统上线后,虽然极大提高了财务造假特别是税务造假的难度,但如何保证财务数据的真实性,一直是监管层的难题。

Because of the lack of effective regulation, manual manipulation of altered accounting books has been adjusted on demand by accounting professionals in various enterprises, including public companies. While the introduction of the fourth phase of the tax project, centred on the supervision of the Tax Administration, has greatly increased the difficulty of financial counterfeiting, particularly tax fraud, it has been a regulatory challenge to ensure the authenticity of financial data.

进入二十一世纪后,成熟资本市场的监管主体一方面加强了法案的颁布,一方面不断通过改进执法技术对市场实施有效监管。比如2004年美国通过的塞班斯法案(Sarbanes-OxleyAct)。我国除陆续对相关法律进行系统性修订外,也对企业会计准则进行了多番增改,然而问题依然亟待解决。

In the twenty-first century, the regulators of mature capital markets, on the one hand, strengthened the enactment of laws and, on the other hand, continued to exercise effective regulation of markets through improved enforcement techniques. For example, the Sarbanes-Oxley Act of 2004 was passed in the United States.

2.分布式数据库Vs区块链

2. Distributed database Vs block chain

目前信息产业部门提出的容灾备份数据库、大数据云,以及非关系型数据库等传统数据库都或多或少提及自己是分布式数据库。但以上概念和区块链的核心区别在以下三点:

The traditional databases, such as disaster-resilient backup databases, big data clouds, and non-relationship databases, which are currently proposed by the information industry, refer more or less to themselves as distributed databases. However, the core differences between the above concepts and block chains are as follows:

首先,区块链不仅仅是利用了分布式数据库,还使数据在不同的用户之间公开共享,而不论是容灾备份数据库,或是大数据云以及非关系型数据库(例如Mongo DB),均设置了超级管理者,并分配给了用户不同的使用权限。

First, the block chain not only uses distributed databases, but also enables data to be shared openly among different users, and either disaster-responsible back-up databases, large data clouds and non-relationship databases (e.g., Mongo DB) have supermanagers in place and are assigned to different user access rights.

其次,区块链利用哈希函数(hash function)来处理原始数据,因此具备数据加密和压缩的特性,通过创建不可更改的带时间戳的日志(time-stampedlog),来实现数据的不可篡改性。而传统数据库则直接存储并向最终用户展现原始数据,加密和授权由传统数据库软件完成。原始记录仍然可以通过超级用户权限来进行更改。例如,遗忘银行密码经过身份认证后,你仍然可以重设密码;但如果遗忘了基于区块链技术的加密私匙,没有任何方式可以重新设定。

Second, the block chain uses the Hash function to process raw data, so it has the features of data encryption and compression, making data immutable by creating immutable time stamped logs (time-stampedlogs). While traditional databases store and display raw data directly to end-users, encryption and authorization is done by traditional database software. The original records can still be modified by super-user privileges. For example, when forgotten bank passwords are authenticated, you can still reset the passwords; if you forget encryption private keys based on block chain technology, there is no way to reset them.

再次,区块链数据合理性认证只能由系统参与者一起进行,而且一旦认证后无法更改。但是传统数据库中超级用户或者授权用户对数据都可以进行认证并修改。

Third, block chain data reasonableness authentication can only be performed by system participants together and cannot be changed once authentication has been completed. However, data can be authenticated and modified either by super-users in traditional databases or by authorized users.

3.区块链应用的可操作性与挑战

3. Operationality and challenges of block chain applications

根据上述分析,区块链数据具备了权限透明性、不可篡改性和认证统一性,对于评估数据更为便利和友好。然而,如何在底层数据中利用区块链技术一直以来是制造业的一大挑战。

On the basis of the above analysis, block chain data have been transparent, non-frozen and authentication uniformity, which is easier and more user-friendly for assessing data. However, the use of block chain technology in bottom-level data has been a major challenge for manufacturing.

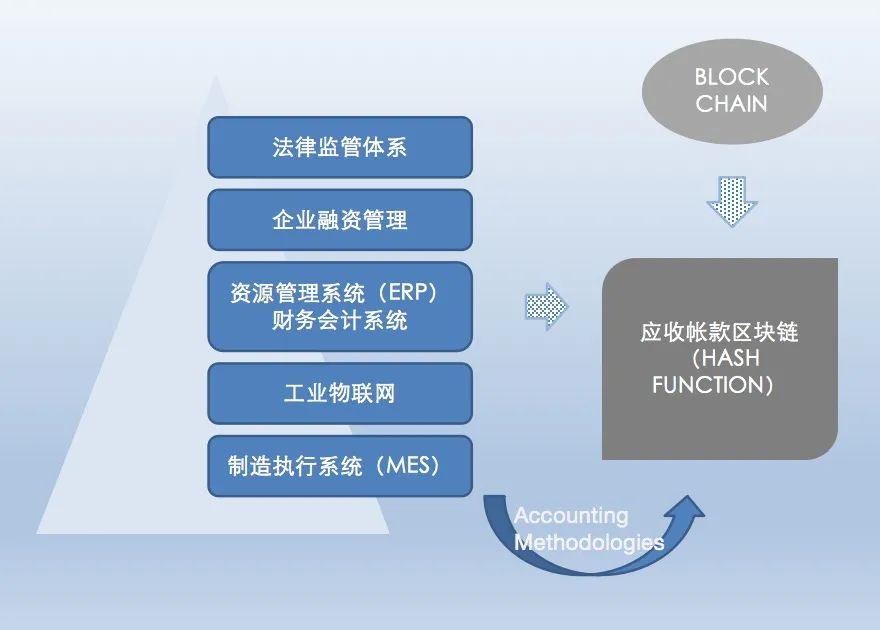

目前很多企业推出的应收账款的区块链认证服务并不能触及制造业企业的底层数据,仅仅是在现代会计业务上的重复电子化数据而已(过程如下图三)。区块链技术如果不能下沉到企业的制造执行层面(MES系统),其自身技术特点也将无法充分发挥。

The block chain certification service, currently introduced by many enterprises, does not reach the bottom of the data for manufacturing enterprises, but merely duplicates electronic data on modern accounting operations (see figure III below). Block chain technology will not be fully developed if it does not sink to the enterprise's manufacturing implementation level (MES system).

图三区块链技术下沉分析

Figure III Technical sinking analysis of block chains

(三)

(iii)

数据使用方案:建立全新系统vs筛选初始数据

Data use options: create a completely new systemvs filtering initial data

1.数据的产生与流动

1. Data generation and flow

质量控制为企业立身之本。任何一个企业,不论原始设备制造商(OEM)、配件厂商、维修商,还是零售商都需要具备成熟的质量控制体系,才能在产业中生存。二十世纪初,质量控制体系逐步建立并完善,现代制造企业已经拥有了一定的自动化程度和电子数据。例如汽车制造,重工制造都会采用AIAG(Automotive Industry Action Group)推荐的行业流程i。而在这一体系的要求流程下,大量数据即会产生,并在参与企业间进行交换。

At the beginning of the twentieth century, the quality control system was gradually developed and refined, and modern manufacturing enterprises already have some degree of automation and electronic data. For example, in automobile manufacturing, heavy manufacturing uses the industry process recommended by AIG, i. Under the system’s requirements, large amounts of data are generated and exchanged between participating firms.

企业产品研发初期须执行并与上下游一起认证产品质量先期策划(Advanced Product Quality Planning:APQP)。在这期间,参与企业间进行了大量的数据交流,包括测试数据、验证数据和分析结果等。这些数据可能产生于企业内部,或则不同的第三方实验室,或者咨询公司。通常这些数据的来源地分散,且都是制造业企业前期投资的结果。

During this period, there has been considerable exchange of data between participating firms, including testing data, validation data and analysis. These data may be generated within the enterprise, or in different third-party laboratories, or consulting firms. These data are usually sourced widely and are the result of prior investment by manufacturing enterprises.

当产品进入到交易环节时,为了品质管控和售后服务,制造商通常需要遵守生产件批准程序(Production Part Approval Process,PPAP)和相关的ISO流程(比如ISO/TS16949),产生包括产品的标定、机器打印序列号以及下线检测等海量系统数据,供应商也同时会有选择地提供部分数据导入上下游企业的售后服务等相关数据库,为制造业的品质监控和流程管理进行服务。

When products enter the trading chain, for quality control and after-sales services, manufacturers are usually required to follow the production approval process (Production Part Approval Process, PPAP) and related ISO processes (e.g. ISO/TS 16949) to generate big system data, including product labelling, machine printing serial numbers and bottom-line testing, and suppliers are also selective in providing relevant databases, such as after-sale services, which import part of the data into upstream and downstream enterprises, to service quality control and process management in the manufacturing industry.

2.数据使用的选择与法律风险

2. Choice of data use and legal risks

在制造业前期和中期产生的海量数据,都会被相应主体有选择地提供给上下游企业。这些数据跨企业流动,并具有海量特性,通常无法进行人为输入。而将其中部分具有金融特性的数据提取出来,并导入区块链系统,就可以实现将区块链的应用下沉到制造业底层数据,从而确保数据的真实性与有效性,降低制造业ABS中的风险。

Large amounts of data generated in the pre- and mid-manufacturing periods are provided selectively to upstream and downstream enterprises by the respective subjects. These data flow across firms and are large in size, often unable to be imported artificially. The extraction of some of these data with financial characteristics and their import into the block chain system would allow the application of the block chain to sink down to the bottom of the manufacturing sector, thus ensuring their authenticity and validity and reducing the risks in manufacturing ABS.

综上,笔者认为针对于制造业企业ABS评估的有效解决方案并非是重新建立一套系统性的基于完全区块链技术的数据存储方案。更可行的方法是利用企业原有的系统,在现有的数据中提出有用的信息,作为区块链hash function哈希函数的初始输入值,然后作为参数提供给上层的金融ABS进行评估。

In summary, I do not believe that the effective solution for the ABS assessment of manufacturing enterprises is to re-establish a systematic data storage programme based on a complete block chain of technology. A more feasible approach would be to use the enterprise’s existing system to provide useful information in the available data as the initial input value for the Hash action Hashi function of the block chain and then provide it as a parameter to the upper financial ABS.

三、结语

III. CONCLUSION

将区块链技术应用于ABS设计中,能够高效实现对基础资产形态转化流程的管理,从而对包括放款、还款、交易或者逾期等金融操作风险进行精准评估,提升ABS的风险评估置信度、提升评估效率。同时,对于投资者和监管机构来说,区块链技术所能实现的信息难以篡改性可以有效提升ABS产品的投资透明度,帮助明确产品风险及收益。2020年3月1日,修订后的《中华人民共和国证券法》(“《证券法》”)正式施行后,将资产支持证券和资产管理产品提升到法律层级进行监管,并授权国务院按照《证券法》的原则规定资产支持证券、资产管理产品发行、交易的管理办法8。这将在对ABS提出更加明确、具体的监管要求和规范的同时,进一步促进ABS的业务发展规模,区块链技术的应用也将能够帮助ABS更好地适应和满足日益提高的审核和监管要求。

The application of block chain technology to ABS design allows for efficient management of the underlying asset morphological transformation process, leading to an accurate assessment of the risks of financial operations, including lending, repayment, trading or overdue, and enhanced confidence and efficiency of ABS risk assessment. At the same time, the information that block chain technology can achieve is difficult to tamper with for investors and regulators to enhance investment transparency in ABS products and help identify product risks and benefits. On 1 March 2020, following the formal implementation of the revised Securities Act of the People's Republic of China (“the Securities Act”), asset support securities and asset management products will be regulated at the legal level, and the State Council will be authorized to prescribe an approach to the management of assets in support of securities, asset management product issuance and transactions, in accordance with the principles of the Securities Act. This will further promote the scale of ABS's business development, along with clearer and specific regulatory requirements and norms for ABS, and the application of block-chain technology will help ABS to better adapt and meet increasing audit and regulatory requirements.

在实务中,制造业企业仅仅是有选择地分享部分数据给上下游企业。因为这些数据既是前期投资的结果,也是后续融资的凭证,而对于海量数据的选择与提取,何为“具有金融特性的数据”,如何分析哪些数据具有知识产权的性质或涉及商业机密应当保护,哪些数据应当放入ABS的融资计划,从法律角度来看,都是需要厘清的问题,而在区块链技术应用下,又有了新的挑战。

In practice, manufacturing enterprises merely selectively share part of the data for upstream and downstream enterprises. These data are both the result of prior investment and evidence of subsequent financing, while the selection and extraction of big data is what is “financially specific data”, how to analyse which data are of an intellectual property nature or should involve the protection of business secrets, which should be placed in ABS financing schemes, which, from a legal point of view, is an issue that needs to be clarified, while new challenges arise with respect to the application of block-chain technologies.

注释:

Notes:

1 Session 10 Page 18, 2018, https://ocw.mit.edu/courses/sloan-school-of-management/15-s12-blockchain-and-money-fall-2018/

2 国务院关于印发《“十三五”国家信息化规划》的通知(国发〔2016〕73号),2016.12.15生效

Notification by the Department of State on the publication of the 13th Five-Year National Informatization Plan (NIP) (2016] 73), effective 2016.12.15

3 《区块链信息服务管理规定》(国家互联网信息办公室令第3号),2019.2.15生效

Regulation of Block Chain Information Services (National Internet Information Office Order No. 3), effective 2019.2.15

4 Session 9 Page 14, 2018, https://ocw.mit.edu/courses/sloan-school-of-management/15-s12-blockchain-and-money-fall-2018/

5 关于防范以“虚拟货币”“区块链”名义进行非法集资的风险提示,2018.8.24https://law.wkinfo.com.cn/legislation/detail/MTAwMTEyNjIxOTU%3D?searchId=bc74f4cc72c6410ba1a94c648d653284&index=1&q=%E5%85%B3%E4%BA%8E%E9%98%B2%E8%8C%83%E4%BB%A5%E2%80%9C%E8%99%9A%E6%8B%9F%E8%B4%A7%E5%B8%81%E2%80%9D%E2%80%9C%E5%8C%BA%E5%9D%97%E9%93%BE%E2%80%9D%E5%90%8D%E4%B9%89%E8%BF%9B%E8%A1%8C%E9%9D%9E%20%E6%B3%95%E9%9B%86%E8%B5%84%E7%9A%84%E9%A3%8E%E9%99%A9%E6%8F%90%E7%A4%BA&module=

5 With regard to the risk of protection against illegal fund-raising in the name of the “virtual currency” “block chain”, 2018.8.24 https://law.wkinfo.com.cn/legislation/detail/MTAwMTEyNjIxOTU%3D?searchId=bc74f4cc72c6410b1a94c48d653284&index=1&q=%E5.5%B3%B3%E4%A%8E9%B2%E8%C8%83%B4B%A2%E2%E9%E9%E9%E9%E6%E6%E8%B9B9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9%E9E9%E9%E9%E9%E9E9%E9%E9%E9%E9E9E9E9E9E9%E9E9E9%E9%E9E9E9E9E9E9E9E9%E9%E9%E9E9E9E9E9%E%E9E9E9%E9%E9%E9E9E9%E9E9E9E9E9E%E%E%E%E9E9E9E9E9E9E9E9E9E%E9E9E9E%E9E9E9E9E9E9E9E%E9E9E9E9E%

6 《区块链信息服务管理规定》(国家互联网信息办公室令第3号),2019.2.15生效

Regulation on the Management of Block Chain Information Services (National Internet Information Office Order No. 3), effective 2019.2.15

7PBFT:https://www.usenix.org/legacy/events/osdi99/full_papers/castro/castro_html/castro.html

8 《中华人民共和国证券法》第一章总则,第二条,2020.3.1

8 General Provisions of Chapter I of the Securities Act of the People's Republic of China, Article II, 2020.3.1.

i AIAG website: https://www.aiag.org/quality/automotive-core-tools/fmea

上海律协投稿通道:

Shanghai Association contribution channel:

shlxwx@lawyers.org.cn欢迎来稿~

Shlxwx@lawyer.org.cn welcomes the contribution.

原标题:《区块链在资产证券化(ABS)领域的应用研究——基于制造业供应链ABS评估的解决方案》

Original title: Applied study of block chains in the area of asset securitization (ABS) - Solutions based on ABS assessment of manufacturing supply chains

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论