先声明一下,本篇是一个关于BTC投资的内容,数字货币在B站因为某些原因整体风向有点像过街老鼠,人人喊打。所以如果你本身对数字货币带有偏见,这里就真没必要往下看了。

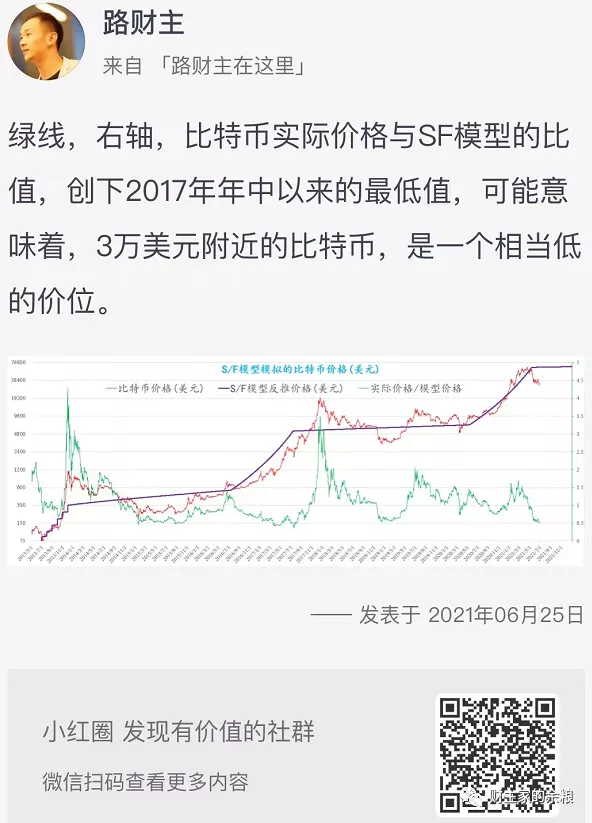

6月25号,我在小红圈里发了如下一段信息:

?

On June 25, I sent the following message in the red circle:

?之所以发这段信息,是因为当时的比特币公允价格,与我修改后的S/F模型所计算比特币的“公允价格”(模型具体参见“明年比特币将5万美元”一文,我们每周也会在“我的区块链”公众号上发布修改S/F模型的最新公允价格)的比值,达到了0.5,这是2018年底以来的最低价格,甚至比2020年3.12的大跌中还要低……?

? The information was sent because the ratio of the then fair price of bitcoin, calculated by my modified S/F model, was 0.5, which was even lower than the previous decline of 3.12 in 2020? .

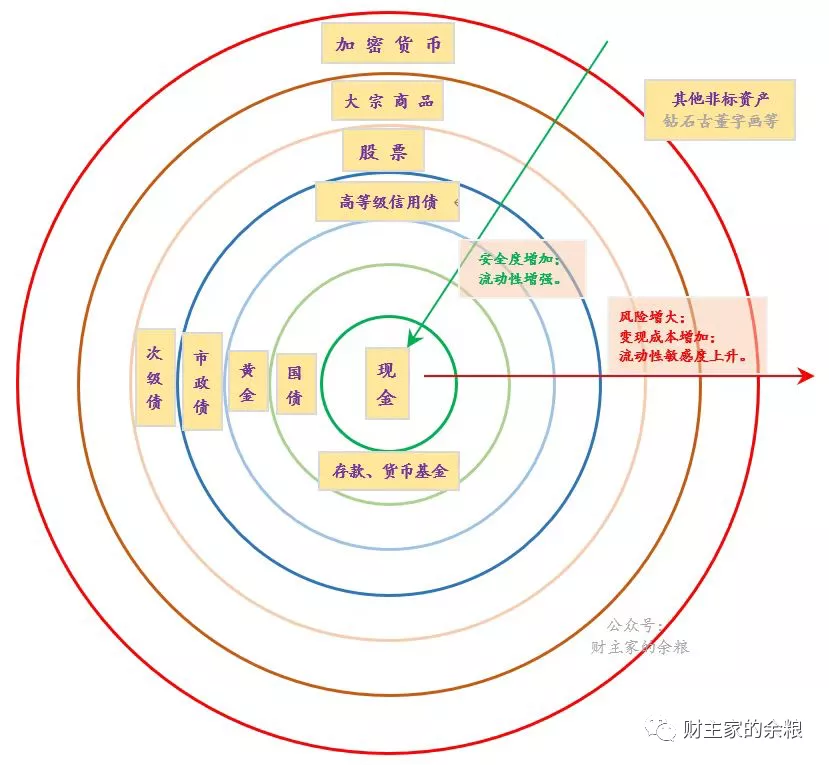

6月26号,我又发了一段信息,并且配了一张我自己画的资产安全性-流动性关系图。

On June 26, I sent another message with a map of

?

?现在,5个月已经过去了,

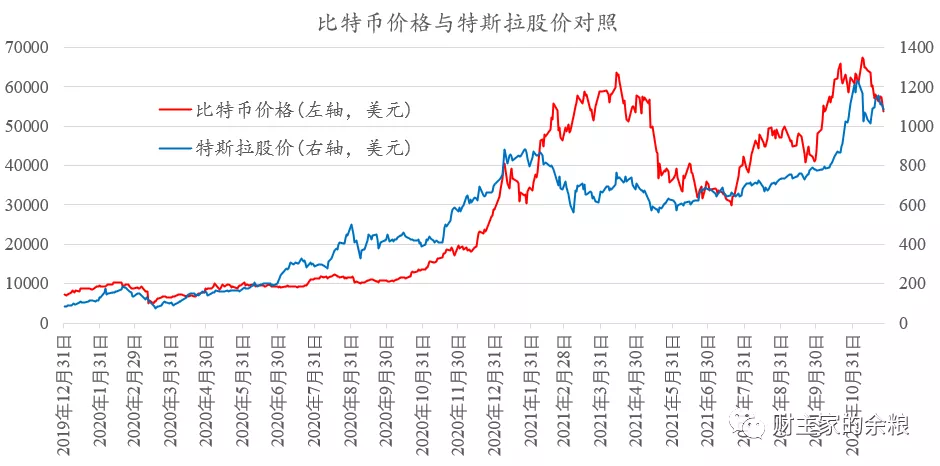

最终的结果是:比特币,又涨了上去; The final result was: bitcoin, up; . 中国和美国的股市,也小跌了一波。? The stock markets of China and the United States also fell a little. 为什么会是这样??我先来解释一下资产安全性-流动性圈层这张图。? Why is that? Let me explain this picture to you first. > /span > /span >. ?在当代信用货币体系之下,整个社会的货币与信贷是一体的(货币==信贷),一旦发生经济问题,不管这个危机大或者小,也不管什么原因引起,本质上都是债务和信贷危机。 ?当信贷危机爆发出来,最开始的表现,就是信贷开始趋紧,所有人都急需能直接偿还债务的现金,而其他所有资产,作为信用货币的镜面,都需要兑换成现金,所以这个时候所有资产的卖出力量,都开始大于买入力量,几乎所有资产都开始波动和下跌。? ? When the credit crisis broke out, the first sign was that credit began to tighten, that all people urgently needed cash to pay their debts directly, and that all other assets, as mirrors of the currency of credit, needed to be converted into cash, so that at this time all assets were sold more powerful than buying power, and almost all assets began to fluctuate and fall. ?在这个过程中,只要美元体系没有崩塌(全局性的法币信任危机),那么,资产变为现金的成本和便捷性,就成为决定资产价格波动的首要因素。? ? In this process, the cost and ease of converting assets into cash becomes the primary factor in determining the volatility of asset prices, as long as the dollar system does not collapse (the global crisis of French confidence). 在标准化的资产中,现金当然是最需要的; Of course, cash is most needed in standardized assets; 其次是国债,因为可以找到政府(央行)换成现金; 再其次是黄金,因为作为千年货币,无论政府还是民间,都接受它转换成现金; and then gold because, as a millennium currency, both government and civil, it is accepted to be converted into cash; 接下来,就是政府(央行)隐含担保的地方政府债券(市政债)和高等级信用债,因为发行这些债券的企业或地方政府,理论上会有足够的现金付给持有人 is followed by government (central bank) implicitly guaranteed local government bonds (municipal debts) and high-level credit debts, since the firms issuing these bonds or local governments would in theory have enough cash to pay the holder ;再接下来,是次级债和股票资产,不确定是否能足额偿付现金;然后,是大宗商品,这个可没人给你保证什么价格;然后,是加密货币; 然后,是钻石、古董、字画等非标准化的资产(包括房地产这种非标资产)。 then non-standardized assets such as diamonds, antiques, paintings, etc. (including non-target assets such as real estate). ?在这些资产中,越靠近核心圈层,那么其波动性越小,危机中的折价也越少,甚至可能上涨;而越往外,资产价格波动幅度越大,对于信贷环境的敏感性也越高,一旦危机来临,其下跌幅度也会越大。?如果仅考虑标准化资产,以比特币为代表的加密货币,正是处于流动性最敏感的外部圈层,其波动和敏感性,都远比其他资产更甚。 ? Among these assets, the closer to the core circle, the less volatile, the less discounted or even higher the crisis; the more volatile the asset price, the more sensitive to the credit environment, the greater the fall when the crisis strikes. If standardized assets are considered, the encrypted currency, represented by bitcoin, is in the most sensitive outer circle of liquidity, the more volatile and sensitive, far more so than other assets. ?讨论完了流动性,我们来对比一下比特币价格与纳斯达克100指数波动,可以发现: . 2019年底之前,可能是因为市值太小、不为大众所知等原因,比特币的价格波动,呈现出自身的规律性,与美国科技股指数关系不大;但是,自2020年初以来,随着疫情发酵与比特币被越来越多的人所知,比特币价格的波动情况,在很大程度上开始与纳指100指数趋同(下图阴影部分)。? By the end of 2019, the price of Bitcoin may have fluctuated, presented its own regularity and had little to do with the United States science and technology unit index; , however, since the beginning of 2020, as the epidemic fermented with bitcoin became increasingly known, the price volatility of bitcoin began to converge to a large extent with the Navigator 100 index (shadowed part below). ?如果大家想一下,应该也可以理解。?加密货币以及附着于其上的区块链技术,本身就是人类科技树发展的新节点。不管理解与否,大多数投资者看待比特币,就像看一个崭新的科技公司一样。 愿意相信其未来美好的人,给予其越来越高的估值;而那些纯粹为了赚钱的投资者,则有可能在价格高位套现。这两种人,一起决定了比特币价格的价格。? 对比另一个当前被投资者毁誉参半的明星科技股——特斯拉,我们发现两者的价格波动具有非常高的相似性。? ?如果把比特币作为一种资产来看待,我认为目前市场上存在两点共识: ? If Bitcoin is treated as an asset, I think there are two points of consensus in the market: . 1)以比特币为首的加密货币,是标准化资产中对流动性最敏感的,也是波动性最大的; An encrypted currency headed by bitcoin is the most sensitive and volatile of standardized assets; 2)与股票资产对比,当前比特币价格的波动特点,像一个明星科技股。? 这就是当前阶段,市场对于比特币作为一种资产的“共识”。?这两天,和一个大量持有比特币的朋友聊天,他特意提醒我,“共识”也是有阶段性的。? This is the current stage of the market's “consensus” for Bitcoin as an asset. 的确如此。?就在2018年之前,比特币价格波动有自己的规律,并不与美股共振,“明星科技股”这个共识并未形成。 但是,自2020年初,特别是2020年3月份的大跌之后,比特币的价格波动,基本上与明星科技股类似,这说明市场形成了新的共识。?所以,我只能说,当前阶段的比特币价格波动,大概率依然会遵循以上两个共识。 But since the beginning of 2020, especially after the fall of March 2020, the price volatility of Bitcoin, largely similar to that of the Star Science and Technology Unit, suggests a new consensus in the market. So I can only say that the current stage of bitcoin price volatility is likely to continue to follow both. 但未来,共识会不会发生变化,会发生什么样的变化,我也不知道。 But in the future, I don't know if the consensus will change, what it will change. 最后声明,本文只做参考,投资需谨慎! 本文首发于公众号:财主家的余粮

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论