作者:Jack,BlockBeats

Author: Jack, BlockBeats

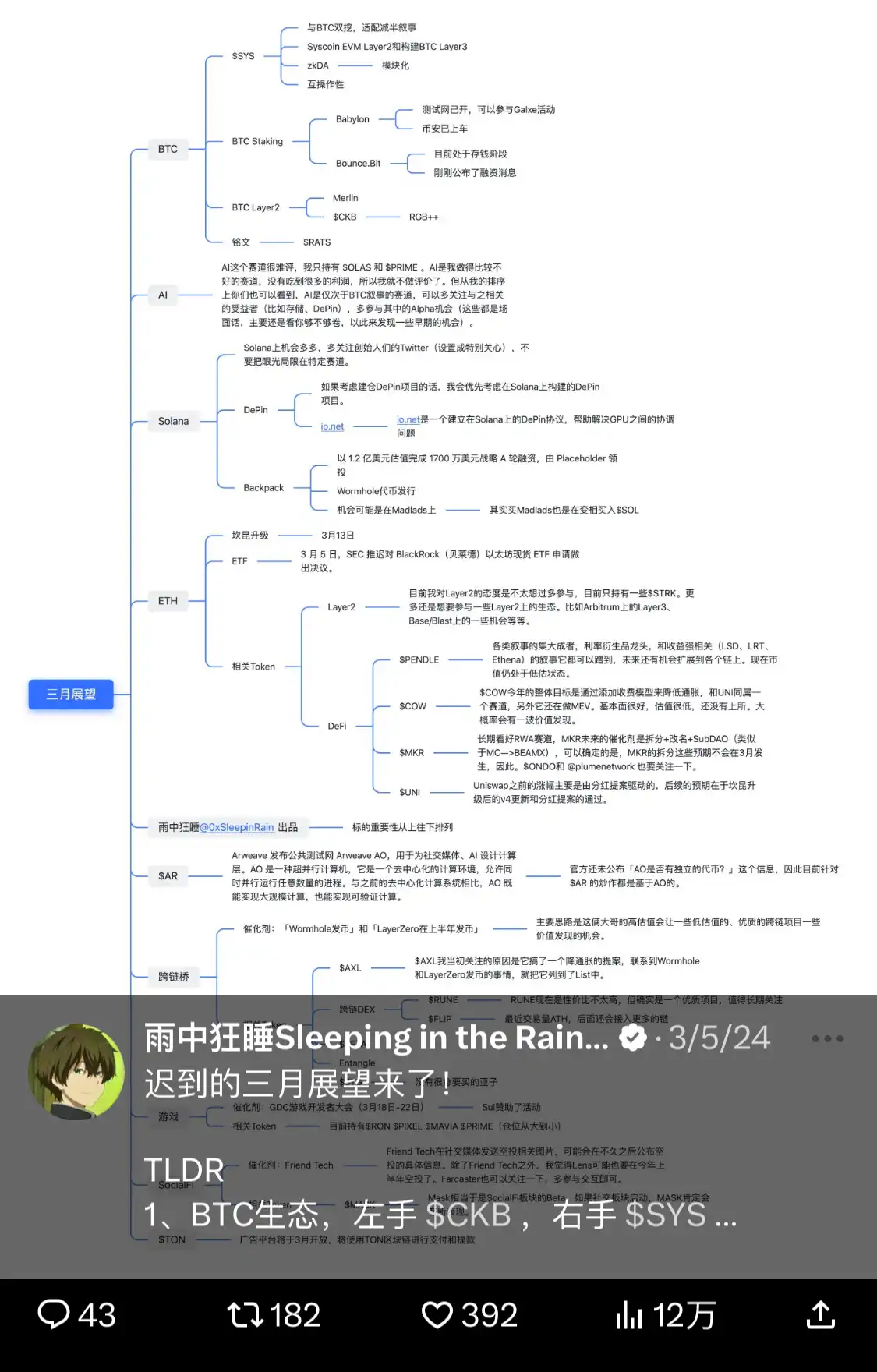

在幣圈,做KOL 的難度越來越高了。在中文加密社群完成推特的遷徙後,市場和一般投資人對KOL 的需求是:有認知、夠專業,並且能夠早發現Alpha 機會。在日漸苛刻的市場標準下,加密KOL 正經歷著新一輪的大浪淘沙,老一代KOL 逐漸淡出舞台中心,同時也給了新一代實力派KOL 崛起的機會。

After the Chinese encrypt community completed its Twitter transfer, the market and the general investor’s demand for KOL was that it be known, professional enough, and that it be able to discover Alpha early. Under the harsh market standards of the day, encryption KOL is going through a new wave of scavenging sand, and the old generation of KOL has faded out of the center of the stage and has given a chance to the rise of the new Power KOL.

近期我們對談的實力派KOL 是雨中狂睡( @0xSleepinRain ),從「炒幣小白」到微博大咖,再到經營自己的付費社群,他成長軌跡絕對是草根散戶逆襲的勵志典型。在一派實力選手中,雨中狂睡給人的感覺就像是班上的學習標兵,每天都在整理和分享自己的學習筆記。用他的話來說,自己的成功秘訣就是「笨鳥先飛」。

In recent times, we have talked about the effective KOL, which is sleeping in the rain ( ), from "false white" to "breathing white" and to the community that runs its own expenses, and his long track is absolutely typical of the incentive to go back to the grass roots. In the hands of the elite, sleeping in the rain is like a schoolmaster in a class, collating and sharing his academic notes every day. In his words, his success is "bucks fly first."

雨中狂睡(以下稱Morty)本科攻讀機械專業,學習材料鍛造、圖面設計等工程技術,用他自己的話說,「畢業後大機率就是進廠打螺絲」。但身為一個理工生,他又與文字工作有不少緣分。從學生時期的淘金歷險,到初入幣圈時的首份工作,以及當前每天的工作日常,都和寫作以及內容創作有緊密的聯繫。不得不說,在目前的加密產業,內容槓桿似乎才是最有效的槓桿。

He sleeps in the rain (hereinafter Morty) and learns engineering techniques such as materials, graphics, and so forth. In his own words, "The big chance after graduation is to go into the factory and screws." But as a scientist, he has a lot to do with writing. From the time of school, the first job at the time of entry into the currency, and the day-to-day work at the time, there is a close connection with writing and content creation.

大學期間,Morty 發現了百家號、今日頭條以及火山視頻等內容平台的機會,於是和自己的同學開始批量運營自媒體號,賺到了第一桶金。實際上在當時,做抖音或許是一個更好的選擇,但因為不太擅長做視頻,Morty 放棄了這個機會,現在回看,這基本上奠定了自己喜歡寫東西的一個狀態。

During college, Morty discovered opportunities for content platforms like 100 homes, today's headlines, and Volcano videos, and began to run his own media numbers in bulk with his classmates, making the first barrel of gold. In fact, it was probably a better choice at the time, but because he was not very good at videotaping, Morty gave up the opportunity, and now looks back, it basically laid down a state that he liked to write.

2018 年Morty 畢業,平台紅利也逐漸褪去,認識到產業前景的限制後,他來到杭州尋找機會。在投遞三四份履歷後,Morty 加入了加密媒體嗶嗶News,從此與加密結緣。一次,他有機會採訪了彼時創業Polkadot 不久的Gavin Wood,覺得這個人很厲害,就買了些DOT。後來在一場上海產業活動上,Maorty 又收到了Cointelegraph 中文團隊的邀請,便二話沒說賣掉了自己的部位,來到上海。

After delivering three or four profiles, Morty joined the encrypted media, News, from which he was connected. Once, he had the opportunity to interview Gavin Wood, a short time-on-time company Polkadot, who thought that he was good, bought some DOTs. In a Shanghai industry event, Maorty received an invitation from the Chinese team, and did not say anything about selling his place and coming to Shanghai.

在這之前,媒體的日常任務對Morty 來說就是純粹意義上的工作,他並不參與炒幣。 2021 年底,看著自己賣掉的DOT 從5 美元漲到60 美元,Morty 逐漸意識到,自己也可以試著炒炒幣,「我有一個人生信條,就是製造回憶,你不能每天都在上班,總要去做點什麼」。

Until then, the media’s day-to-day mission was pure work for Morty, who was not involved in the writing of coins. At the end of 2021, when the Dot that he sold went from $5 to $60, Morty realized that he could also try to fire the coin, “I have a life doctrine, a memory, and you can’t work every day, and you have to do something.”

BlockBeats:當時對你影響比較大的是哪個專案?

BlockBeats: Which project did it affect you more?

雨中狂睡:對我影響最深的還是Burger Swap,這是BSC 上的第一個DEX,它那時從0.5 美元漲到27 美元。當時我因為沒什麼錢,就每天少吃一頓飯去買,在0.5 美元左右買了對於那時的我而言比較多的BURGER,雖然也不能算多,但買了大概2000U 左右,然後在7美元左右賣了一半,後來它又漲到27 美元,我沒賣,最後再跌回7 美元的時候才全部賣完。當時其實也不太懂,如果讓我現在回到那個時候,一定會做得更好。

The worst impact on me in the rain was Burger Swap, the first DEX on BSC, which rose from 0.5 to 27 dollars. At that time, because I had no money, I bought less meals every day, bought more BURGER for me at about 0.5 dollars, but bought about 2000U, then sold about half of it at $7, then it went up to $27, and I didn't sell it until I fell back to $7.

BlockBeats:還有哪些項目對你的影響比較大?

雨中狂睡:對我影響比較大的可能是Avalanche 和Solana,Solana 是影響最大的,我大概是35 到45 美元左右買入的SOL,在80 美元時賣了25%、100 美元賣了25% ,到120 美元又賣了25%,直到140 美元的時候全部賣完,我也沒想到最後它會漲到200 美元。

Sleeping in the Rain: could have affected me more than ever: Avalanche and Solana, Solana was the one who probably bought SOL from $35 to $45, sold 25 per cent at $80, sold 25 per cent at $100, sold 25 per cent at $120, sold all at $140, and I didn't think it would eventually rise to $200.

當時在Binance 上了倉位,但買完就「519」了,SOL 跌到26 美元的時候又加倉了一些。印像中,在那年下半年,最早開始漲的就是SOL,漲到70 到80 美元,然後市場就開始瘋狂了。後來Avalanche 我也有想法,因為當時基金會開了一個Avalanche Rush 給了不少激勵,我覺得可以吸引市場的注意力。不過Luna 我就完全錯過了。

In print, the first thing that started to rise in the second half of the year was SOL, which rose to $70 to $80, and then the market started to go crazy. And then Avalanche, I thought, because the fund would have given a lot of inspiration to an Avalanche Rush, and I felt that I could draw market attention. But Luna completely missed me.

BlockBeats:上一輪加密週期還是「微博喊單」的天下,多數2021 年或2022 年入圈的新人很難從「帶單老師」那裡學到有用的投資邏輯,你的認知是如何構建起來的?

雨中狂睡:在我成長的路上遇到了很多貴人。例如Cointelegraph 中文的前同事、22 年年底熟識的朋友、微博/Twitter 上認識的KOL,他們教會了我很多。例如,他們讓我理解了一個東西,叫訊息的傳遞。

Sleeping in the rain: met a lot of dignitaries on my way to growing up. For example, Cointelegraph's former colleague in Chinese, his familiar friend at the end of the year, KOL, who taught me a lot. For example, they made me understand a thing called the transmission of messages.

比如說,專案方的資訊是A 層,到了VC 這裡可能就是B 層。如果專案方要做一件事情,最先知道的一定是VC,最後知道的才是散戶。而這個傳導的過程,可能就決定了價格的漲勢,所以在最後散戶可能就是一個「接盤的過程」。另外他們也讓我意識到,原來炒幣也是能賺錢的,這讓我有了更多興趣去做大量閱讀以及思考之類的工作。

For example, the project's information is level A, and this is probably level B. If the project has to do something, the first to know must be VC, and the last to know is the dispersed. And the process of this transfer may determine the price increase, so it may be a "take-over" at the end.

2021 年下半年,Morty 還在Cointelegraph 中文任職,自己一開始也沒有做KOL 的想法,但因為一直有寫作的習慣,整理出信息後只給自己似乎有些浪費,於是便拿出來在社交媒體上與大家做分享,一年後,他便成了微博粉絲過萬的知名加密KOL。

In the second half of 2021, Morty took up his post in Chinese in Cointelegraph and did not think of KOL in the first place, but because he was always used to writing, sorting out the information and giving him what seemed to be a waste of time, he took it out to share it with you in social media, and a year later he became a famous microblogging fan.

2022 年9 月,一位K 線分析師找到Morty,希望能與他一起合作做收費群,但Morty 認為自己還沒準備好,於是一直花時間做Notion 整理等籌備工作。儘管最終並未合作成功,但這件事給了Morty 一個建立社區的好契機。

In September 2022, a K-line analyst found Morty, hoping to work with him on a collection, but Morty thought he was not ready, and took time to prepare for the Notion. Although it did not work, it gave Morty a good opportunity to build a community.

2023 年底,Morty 徹底離開微博,並與自己的好夥伴黃饅頭合夥,開始了自己的付費社群。黃饅頭與Morty 是在深潮工作時的同事,平時就是一人找信息,一人做分析,合夥後,黃饅頭還是負責找Alpha 信息,而Morty 則對市場和敘事做分析。從去年底開始,Morty 的付費群從200 人慢慢漲到300 人,再到目前的近500 人,在他看來,做社群也讓他變成了一個更有自信的人。

At the end of 2023, Morty left Twitter and joined his own good partners, starting his own paying community. Yellowhead and Morty are colleagues in the tide, usually one person looking for information, one person for analysis, and later, the other for Alpha, while Morty analyzes markets and narratives. From the end of last year, Morty’s spending grew from 200 to 300 people, and now nearly 500, and it seems to him that being a community has turned him into a more confident person.

BlockBeats:這個社區打算做到多大?

雨中狂睡:以群友的數量看,可能500 就不往外招了。如果我純割韭菜的話,我社群也不會到這個人數,而且我也在一直很認真的做社群,我會把很多我看到的、認為很重要的東西發在群裡,也會發自己個人的投資操作。

Sleeping in the rain: may not be able to use 500 in numbers of friends. If I cut vegetables, my community won't be there, and I've always been serious about being a community, I'll send a lot of what I see, what I think is important, and I'll make my own investments.

BlockBeats:這種判斷能帶給你正向回饋?

雨中狂睡:對,而且做社群的時候認識了很多很有意思的人,他們也會帶給你正面的回饋。很多群友雖說是付費進的群,但他們也會帶給我很多新的思考,我認為這還蠻酷的。所以讓我更有信心和興趣去把這個事情做好。

Sleeping in the rain: Yes, and having known a lot of interesting people in the community, they'll give you a positive response. Many friends, though they say they're paying, will bring me a lot of fresh thinking, I think it's cool. So I'm more confident and interested in doing this right.

BlockBeats:經營這個社群會消耗很多精力嗎?

雨中狂睡:我習慣了,我會把這個事情跟我自身的成長結合在一起。其實做社群也是自己成長的過程,我覺得這是很酷的事。比如說你做閱讀,你會給社群的成員去看,說一些自己的思考,然後就會有很多人跟你交流。這種社群的回饋其實也是一種訊息流,包括他們現在的情緒,我也能感知到的。其實都是你自己去觀察市場,理解市場,脫離市場去做交易其實很難,我認為這能很好地幫到我,讓我跟市場聯繫得更緊密。

I'm used to sleeping in the rain: , and I'm going to combine this with my own growth. Being a community is also my own development, and I think it's cool. For example, if you read, you'll show the members of the community some thoughts, and then you'll have a lot of people talking to you. This community's echo is also a message, including their current mood, and I can feel it. It's really hard for you to look at the market, understand the market, get out of the market and make a deal, and I think it's good for me to help me and get closer with the market.

BlockBeats:除了自己的社群成員,你會和其他業界的從業人員頻繁交流嗎?

雨中狂睡:有些固定的人,有做單純交易的,也有做擼毛的,還有一些聰明錢之類。我蠻喜歡這種溝通過程,溝通更能讓自己理解到,「原來他們是從這個角度看問題的」。我認為單打獨鬥還挺難的,思維上會存在資訊繭房,現在Twitter 推薦其實也是繭房,所以我會透過郵件訂閱、建立Twitter List 的方式來擴大自己的資訊流。

Morty 非常相信笨鳥先飛的智慧,不論是在嗶嗶News、Cointelegraph 中文還是後來的深潮,他都盡可能地從別人身上學習新的東西,「你必須要提升認知,最後,你的資產一定會回歸到你的認知曲線上」。在Cointelegraph 以及深潮的經驗給了Morty 許多啟發,他學到最重要的兩點,一是資訊的傳遞,第二就是要建立自己的資訊流。

Morty believes in the wisdom of the stupid bird to fly first, whether in News, Cointeelegraph, or later, he learns new things as much as he can from others: "You must raise awareness, and finally, your assets will return to your cognitive curves." Many of the inspirations come to Morty from Cointegraph and the depth of the tide, and he learns the two most important things: the transmission of information, and the creation of his own information flow.

BlockBeats:你要怎麼建立有效的資訊取得框架?

雨中狂睡:我會習慣性的把自己認為好的內容都訂閱,我在Substack 上用郵件訂閱了很多帳號,包括在X 上也有關注的List,這裡面有很多其他人的觀點,我會加上自己的思考再去做一些判斷。

Sleeping in the Rain: I get used to ordering what I think is good, and I book accounts on Substack, including List on X, where there are a lot of other people's points of view, and I add my own reflections to some judgment.

另外我會把自己一直在看的東西整理成一個List。有專案庫,就是看過的一些項目,有社區會議的記錄,很多我認為好的文章也會放到這裡。這方法不一定好,但我認為能產生一些思考和觀點。雖然這些東西我都是公佈給大家的,但其實很少人看,其實相當於為自己的閱讀做一個記錄。

And I'm going to put what I've been looking at into a list. There's a database of projects that I've seen, and there's records of community meetings, and there's a lot of good articles that I think are going to put here. That's not a good idea, but I think there's some thinking and perspective.

但有一個我在年初沒有弄好的敘事就是Solana,當時我把它排在四星敘事,但現在看來它各方面表現都很強,其實是五星敘事。

But one of the things that I did not finish at the beginning of the year was Solana, when I ranked it in four stars, but now it seems to be very strong in all its aspects, actually five stars.

BlockBeats:我看到你後來把它排到了以太坊上邊。

雨中狂睡:我現在理解下來,以太坊是非常大的一個資產,歐美也在推這個點,它可能有復雜性,但是它的地位是Solana 無可撼動的。我不知道以太坊可不可以復刻,但是你需要時間。從這個角度來講,比特幣L2 我基本上都沒有參與,我為什麼不去以太坊或Solana 上玩呢?當然我認為這裡是有財富機會的,因為有註意力在,它是一個長期可持續的事情。以太坊的話,貝萊德的RWA 是在放在以太坊上,既然貝萊德都這麼做了,那我就會追隨一下ONDO 之類的標的。

BlockBeats:每次你在群組分享現貨交易想法時都會設定停損線,「現貨停損線」這個概念是怎麼來的?

BlockBeats: How does the concept of a "stop line" come about?

雨中狂睡:停損更多的是給社群設的,我們每個人的風險承受能力是不一樣的,比如說在某些標的上,我可以承受更大的風險,但你可能就不行。我的一個問題是我「很左側」,有些我特別看好的幣會對它的走勢有很高的預判,導致我很多幣都拿的很難受。例如我認為意圖敘事下的COW 很有機會,所以就一直拿著也不急,還有就是Solana 上的WEN,這波回撤都是因為我太鑽石手了。

Sleeping in the Rain: is more for the community, and the risk tolerance of each and every one of us is different, for example, on some labels, I can take a greater risk, but you may not. One of my problems is that I'm "very left" and some of my specially regarded coins are highly predictable, making it difficult for me to take many of them. For example, I think that the COW under the cover of the plan has a good chance, so I'm not in a hurry, and it's the Wen on Solana, and it's all because I'm too stoned.

BlockBeats:你的「左側打法」都有哪些?

雨中狂睡:判斷敘事的催化劑。例如我認為意圖敘事在坎昆前後可能會漲,就買入UNI 和COW,當然他們最後漲可能不是因為這個原因,這其中也有部分是運氣。在有的標的上運氣可能就沒有那麼好。我需要等很久來印證我自己的邏輯,但如果在之前它漲了很多,且我認定我等的催化劑還沒來,那我大概率就不會賣。在這個PVP 市場,敘事輪動很快,鑽石手也容易受傷。

"Strong" sleeps in the rain: a catalytic agent to judge the story. For example, I thought that the intention was that the event might rise after Cancún and buy UNI and COW, which, of course, might not be the reason for the final upswing, which may also be part of luck. There may not be so much luck on the mark. I need to wait a long time to prove my logic, but if it does so before, and I believe, I would probably not sell it. In this PVP market, the windmill is fast and the diamondman is vulnerable to injury.

BlockBeats:其實4 月的回檔很多人都沒來得及下車,幾乎沒人想到小熊市會持續這麼久。

BlockBeats: In fact, many of the April returns didn't get out of the car in time, and hardly anyone thought the Cub City would last that long.

雨中狂睡:其實市場已經告訴你了,比如說比特幣月線六連陽,其實是要有一個回檔需求的。我認為當時我有機會走,但還是自己沒有想清楚,這也是我的一個失誤。

Sleeping in the Rain: The market has told you, for example, that the six-sun line of the Bitcoast is about to have an echo demand. I think I had a chance to leave, but I didn't think clearly, and it was my mistake.

BlockBeats:沒有想清楚什麼?

BlockBeats: Wasn't thinking clearly?

雨中狂睡:沒有想清楚回檔的需求和回檔的力道可能是多少,以及和山寨幣養出了感情。

Sleeping in the Rain: does not figure out what the needs and the strength of the returns may be and how much affection with the mountain coins.

BlockBeats:你認為這輪週期還有哪些炒作預期?

雨中狂睡:除了降息後流動性回歸的預期外,宏觀還有對大選的預期。在這個預期下,各方的訴求應該是穩定和對加密選民的爭奪。但如果後續沒有新預期支撐,市場可能就會進入沉寂的狀態。現在流動性也不太好。我不會太樂觀。當然,等流動性回來後,就會出現新的一波機會。這是一個很長期的事。

Sleeping in the Rain: has a vision of the elections beyond what is expected to be a dynamic return after a drop in interest. In this scenario, the demands of the parties should be stability and competition against the encrypted voters. If there is no further prognosis, the market may fall into a state of silence. Now it is not good. I will not be too optimistic. Of course, when it comes back, there will be a new wave of opportunities. This is a long-term event.

BlockBeats:嗯,每個週期都不太一樣吧?

Block Beats: Well, isn't it different every week?

雨中狂睡:對,我認為預測不重要,應該思考市場處於一個什麼狀態。例如4 月29 號那天,我會認為市場進入底部階段是因為我看到社群的情緒太悲觀了,有種深熊的感覺。但你想,今年是大選年,其實不太可能會有大事件爆出來,至少是要平穩一點的。

Sleeping in the Rain: Yes, I don't think it's important to predict what the market is in a state. On April 29, for example, I would think that the market entered the bottom stage because I saw the community feeling too pessimistic and had a deep bear feeling. But you think that this year is the year of the election, and it is unlikely that a big event will come out, at least a little more flat.

當時看空的人太多,所以我覺得可以抄底一些標的,當時選擇了以太坊,它生態相關的標的也買了很多,反正有止損線,如果自己判斷錯了就投降。

There were too many people who were emptied, so I thought it would be possible to write down some of the labels, which had been chosen by Etheria, which had been bought by a large number of its ethos-related labels, but had a line to stop the damage and surrender if I misjudged.

BlockBeats:現在關於高FDV 低流通的討論很多,你怎麼看?

BlockBeats: There's a lot of talk about high FDV low circulation. What do you think?

雨中狂睡:我認為這會帶來新的敘事,市場也會去找全流通、零解鎖且已經被市場充分定價的Token。其實Cobie 那篇文章我也看了,他的核心觀點是說市場的買盤其實在一級就發生了,而不是在二級,那就可能導致新幣上線表現沒有那麼好。

Sleeping in the Rain: I think it will bring new narratives, and the market will look for Token, who is in full circulation, unlocked, and already fully priced by the market. In fact, Corbie's article , whose core view is that the market's buying has actually taken place at the first level, rather than at the second level, which may lead to a new currency that is not as good as it is.

其實之前社群媒體上就已經有關於「互不接盤」的討論了,我認為很重要的一點在於,這是市場的問題,市場會逐漸意識到然後去改善。我認為市場之後可能慢慢成長到更聰明的狀態,而且本質上其實是市場流動性不夠。

In fact, there has already been a discussion in the social media about "no game," and I think it's important that this is a market problem, and the market will become aware of it and then improve. I think that the market may slowly grow to a more intelligent state after that, and that it is essentially not as dynamic as the market itself.

BlockBeats:你認為之後的加密市場還會有過去幾輪多頭市場的「超級大漲幅」嗎?

雨中狂睡:我認為會有,因為幣圈給了我們一個賭博的機會。雖然不能經常性把幣圈營造成一個賭場,但就像GCR 提到的,很多人參與幣圈的原因就是因為它像一個賭場,它比去澳門更便捷,而且賺錢的確定性(可能)比澳門高。所以幣圈和山寨幣不會消亡的,只要市場有需求,它就會一直存在,就會有人基於山寨來做文章。

Sleeping in the rain: I think there will be, because the currency ring gives us a chance to gamble. Although it is not always possible to create a casino in the ring, as the GCR has said, many people participate in it because it is a casino, it is easier than going to Macau, and it is more certain of making money than it is. So the ring and the mountain coins are not going to die, and as long as there is demand in the market, it will always exist, and someone will write on the basis of it.

BlockBeats:接下來一段時間,你會專注在哪個方向?

BlockBeats: Which direction will you focus for the next time?

雨中狂睡:我現在主要部位在以太坊上,例如,Pendle 是我的長期部位。這在我五月展望裡有提到,當然我在寫的時候把ETH 放得比較靠後。另外AI 也放在了比較靠後的位置,一是因為最近催化劑比較多,二是因為整體的市場很反人性,大家都看好AI 的時候,它的表現就不好了,需要洗掉那些看好的人們。

I'm sleeping in the rain: I'm in Ether now, for example, Pendle is my permanent part. This is mentioned in my May vision, of course, when I put the ETH behind me. AI is also in a lower position because the market as a whole is antihuman, and it's not working well, and it needs to wash away the good people.

另外Solana 我也有一些持倉,但我通常不會主動購買。對於Solana 的主要任務我也寫在了群名上,就是累積手上的幣本位。多參與Solana 生態,一切都是為了手中SOL 幣本位的成長。

In addition, I have some warehouses, but I don't usually buy them. The main task of Solana is also written in his name, which is to build up the currency in his hands. Much of Solana's life, it's all about the growth of the SOL currency in his hands.

BlockBeats:最後一個問題,你認為山寨市場還要多久才能回到原來的價格位置?

BlockBeats: Last question, how much longer do you think it's gonna take to get back to the price?

雨中狂睡:我還是比較看好後市的,尤其是以太坊,破新高有機會的。等預期透支完後,我就會選擇休息。

"Strange" sleeps in the rain: I'm still more interested in the late market, especially in the Etherkom, where there are opportunities. When the expected overdrafting is over, I choose to rest.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论