作者:Crypto, Distilled

Author: Crypto, Distilled

编译:Felix, PANews

This post is part of our special coverage Egypt Protests 2011.

加密市场的下一走势是什么?市场如战场。熊市与牛市之间的差距只会越来越大。加密分析师Benjamin Cowen对加密市场的未来进行了预测,认为BTC和ETH主导地位将会增强,山寨币兑比特币(ALT/BTC)的走势与2019年夏季类似。

What is the next trend in the encryption market? The markets are like battlefields. The gap between Bear and Cowen is only growing. The encryption analyst Benjamin Cowen predicted the future of the encryption market, arguing that BTC and ETH would be more dominant, and that the trend was similar to that of ALT/BTC in the summer of 2019.

要点:

- BTC主导地位整体处于上升趋势

- 蓝筹股主导地位将进一步提升

- ETH/BNB/TON 逆势上涨

- ETH现货ETF的影响或被夸大了

- 一旦市场注意力触底,山寨币便触底

ETF对比特币的影响:

ETF the influence of bitcoin:

许多投资者对ETF持有量激增,但比特币走势却不佳而感到困惑。Ben认为,加密市场的规模远远大于ETF的流量。还有许多被忽视的流动资金来源,例如鲸鱼老玩家。

Ben argues that the size of the encryption market is much larger than the flow of ETFs. There are many neglected sources of mobile finance, such as whale old players.

为何如此痴迷于ETF?

Why are you so obsessed with strong?

对ETF的热情很大程度上源于个人偏见。具有讽刺意味的是,“无钥即无币,币钥为一体”的支持者也在推动ETF。这种前后不一致揭示出一股关键力量在起作用:博傻理论(注:博傻理论是指一项资产的价格是由人们的预期所决定)。

Ironically, the supporters of “no key, no currency, no key” are also pushing the ETF. This incoherence reveals a key force at work: the bozo theory (note: the bozo theory is that the price of an asset is determined by people’s expectations).

山寨币展望:未来趋势如何?

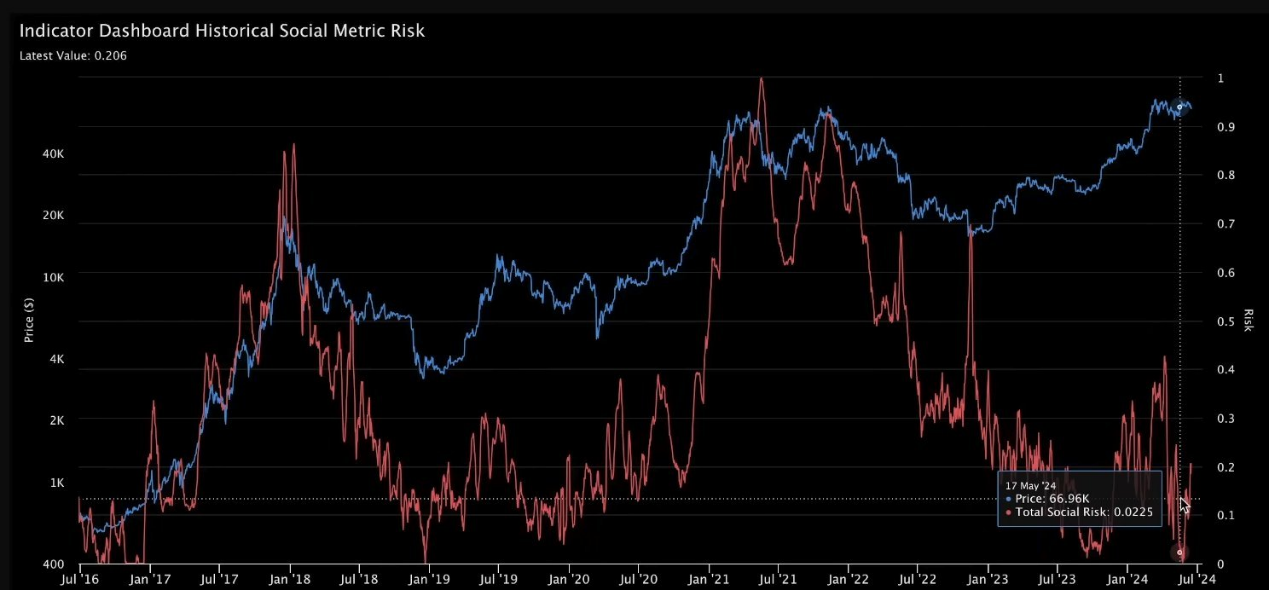

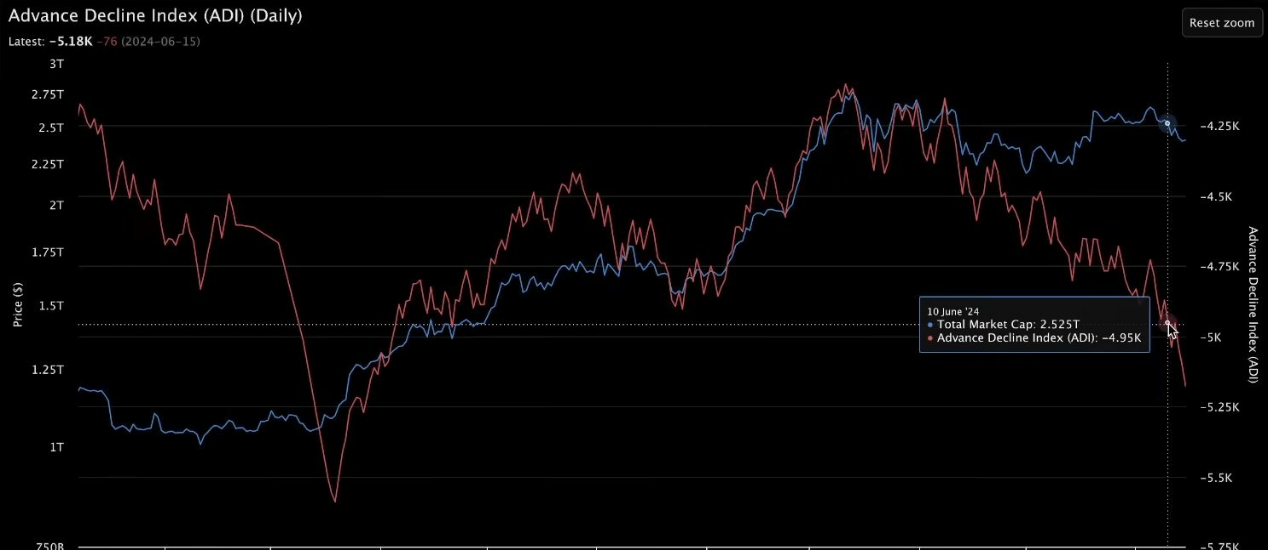

山寨币市场正处于关键的支撑。预计市场向下突破,可能引发进一步的回落。 The bounties market is in critical support. The expected market break-down could trigger further decline. Ben的观点源于:大多数ALT/BTC都趋于震荡。 Ben's point of view stems from the fact that most ALT/BTCs are in shock. 为什么看跌山寨币? Why do you look down on the mountain? Ben的悲观观点集中在市场注意力上。山寨币因受到关注而蓬勃发展,从而塑造了其叙事和价格走势。目前的社会风险指标(Total Social Risk)异常低,为0.02/1,表明散户兴趣极小。 Ben’s pessimistic view is focused on market attention. The mountain coins have flourished as a result of attention, shaping their narrative and price trends. ALT/BTC何时触底? When does it hit the bottom? 一旦社会风险指标达到更低的低点,ALT/BTC可能会触底。当前市场情况与2019年夏季美联储降息前的情况类似。2019年和2024年的社会兴趣在减半之前都有所反弹,但之后又有所下降。 The market situation is similar to that of the Federal Reserve before the summer of 2019. Social interest rebounded in 2019 and 2024 before it was halved, but then declined. 涨跌指数(ADI): up and down (`strong' ADI ): 一种可视化山寨币资本化的方法是使用ADI。ADI是根据每天上涨代币数量与下跌代币数量的比率编制的指标,反映市场的总体趋势。最近行情表明,下跌的山寨币比上涨的多。不要与趋势作对。 One way to visualize the capitalization of the mountain currency is through the use of ADI. The ADI is an indicator based on the ratio of the daily increase in the number of tokens to the decline in the number of coins, reflecting the overall trend in the market. BTC—暴风雨中的平静 BTC - 虽然Ben对大多数山寨币持看跌态度,但BTC具备一定韧性。此外Ben还强调了ETH、BNB和UNI的相对强度。 Ben has a strong attitude towards most of the bounties, but BTC has a certain resilience. Ben also highlights the relative strength of ETH, BNB, and UNI. Ben没有详细说明为什么ETH和UNI坚挺。一个合理的理由可能是DeFi的韧性。在市场普遍疲软的情况下,出现了一些强劲迹象。 Ben did not elaborate on why ETH and UNI were strong. A good reason could be the resilience of DeFi. In a generally weak market, there were some strong signs. 疲弱的Total3 {\bord0\shad0\alphaH3D}The weak {\/strang}Total3 Total3指标(除BTC和ETH之外的所有其他加密货币的总市值)仍低于其20W移动平均线。 The Total3 indicator (the total market value of all encrypted currencies except BTC and ETH) is still below its 20W moving average. 这并不意味着山寨币已经消亡,但有选择性的投资至关重要。 This does not mean that the mountain coins have died, but selective investment is essential. 小市值 vs 大市值: 另一个有趣的观点是OTHER - Total3 / OTHERs。这是对低市值山寨币与高市值山寨币的对比。 Another interesting point is that OTHER - Total3 / OTHERS. This is a comparison of low market value and high market value. 最近,较高市值的山寨币回报率明显优于其他代币。Ben预计,类似于2022年年中,低市值山寨币可能会出现进一步下跌。 More recently, the return on the higher market value is clearly better than that on other currencies. Ben expects that, similar to mid-2022, the lower market value on the market may fall further. 比特币的统治地位会很快达到顶峰吗? Will Bitcoin's reign soon reach its peak? BTC的统治地位还没有达到顶峰。这是因为比特币没有跌破其20W移动平均线。比特币保持稳定在6万至7万美元之间,而其他代币则出现下滑。 BTC’s dominance has not yet peaked. This is because Bitcoin has not broken its 20W moving average. Bitcoin has remained stable between $60,000 and $70,000, while other currencies have fallen. BTC主导地位整体呈上升趋势: BTC overall upward trend: 这个周期的显著特征是山寨币没有出现普遍上涨。其结果就是,BTC主导地位整体呈上升趋势。 The notable feature of this cycle is that there has not been a general rise in bounties. As a result, the BTC dominates with an overall upward trend. 蓝筹代币占主导地位: Blue Funded Currency Dominant: 这一趋势也延伸到了蓝筹代币的主导地位:BTC和ETH的主导地位上涨。 This trend also extends to the dominant position of the blue currency: the rise in the dominance of BTC and ETH. 预计这一数字将接近73%,甚至有可能达到80%的上限。市场近期数据约为73%,已进入区间上限。 This figure is expected to be close to 73 per cent, with the possibility of even reaching the 80 per cent ceiling. The market is about 73 per cent in recent times and has reached the inter-zone ceiling. BTC主导地位(不包括ETH): BTC dominance (excluding ETH ): BTC主导地位最近的下跌完全是由于ETH现货ETF的炒作。除ETH外, BTC的主导地位仍然强劲。 The recent decline in BTC dominance is due entirely to the ETH spot ETF. With the exception of ETH, the BTC dominance remains strong. ETH/BTC展望: ETH/BTC Outlook: 现货ETF的炒作可能会暂时提振ETH。不过,预计ETH/BTC长期来看将呈下行趋势。这是因为美国的货币政策没有改变,尽管比特币在困难时期表现出色。 The current ETF campaign may temporarily boost ETH. However, ETH/BTC is expected to show a downward trend in the long run. This is because monetary policy in the United States has not changed, although Bitcoin has performed well in difficult times. ETH/BTC何时见底? ETH/BTC可能会在美联储降息或量化紧缩结束后触底,但这些事件尚未发生。 ETH/BTC may have reached the bottom of the Fed after the end of the reduction of interest rates or quantitative austerity, but these incidents have not yet occurred. 在限制性货币政策的背景下, BTC的表现可能超过ETH 。 In the context of restrictive monetary policies, BTC is likely to outperform ETH. 预测失效的条件? predicts failure? Ben对ETH表现出色的可能性持开放态度。特别是ETH/BTC在7月份保持牛市区间上方。值得一提的是,Ben没有预测出5月底ETH价格飙升。因而此次预测可能再次错误。 Ben is open to the possibility of ETH showing off. In particular, ETH/BTC stayed above the bull city in July. It is worth noting that Ben did not predict a sharp rise in ETH prices at the end of May. 值得注意的是,在加密领域,悲观的观点往往比乐观的观点更容易合理化。然而,重要的是不要忘记市场的非理性本质。强反身性可以在一瞬间引发巨大的价格波动。 It is worth noting that in the area of encryption, pessimism is often easier to rationalize than optimism. However, it is important not to forget the irrational nature of markets. PANews注:反身性指价格上涨吸引买家,买家追涨进一步推高价格,直到这一过程变得不可持续。同样的过程可以是反向的,即导致价格下跌至灾难性的崩溃。 Note PANews : Inversely, price increases attract buyers, and buyers chase higher prices further, until the process becomes unsustainable. The same process can be reversed, i.e. cause prices to fall to catastrophic collapse. 相关阅读:知名交易员Andrew Kang:为什么ETH现货ETF无法像BTC那样成功? Read about it: The well-known trader Andrew Kang: Why can’t the ETH spot ETF succeed as BTC?

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论