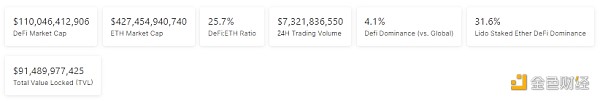

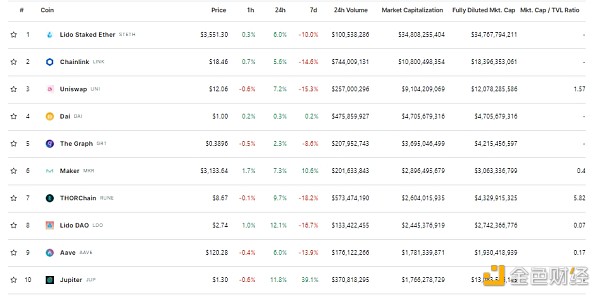

1.DeFi代币总市值:1100.46亿美元

1. Total market value of DeFi: $110.046 billion

DeFi总市值 数据来源:coingecko

2.过去24小时去中心化交易所的交易量73.21亿美元

2. $7.321 billion worth of transactions to the centralized exchange over the past 24 hours

过去24小时去中心化交易所的交易量 数据来源:coingecko

3.DeFi中锁定资产:96.51亿美元

3. Locked assets in DeFi: $9.651 billion

DeFi项目锁定资产前十排名及锁仓量 数据来源:defillama

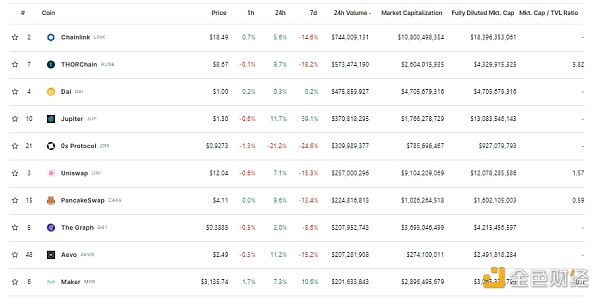

1.NFT总市值:581.07亿美元

1. NFT total market value: $5,8107 million

NFT总市值、市值排名前十项目 数据来源:Coinmarketcap

2.24小时NFT交易量:55.72亿美元

2.24-hour NFT transactions: $5,572 million US$

NFT总市值、市值排名前十项目 数据来源:Coinmarketcap

3.24小时内顶级NFT

3.24 hours top NFT

24小时内销售涨幅前十的NFT 数据来源:NFTGO

Global X即将推出BTC期货策略ETF,代码为BTRN

彭博ETF分析师James Seyffart在社交媒体表示,Global X的BTC期货策略ETF将于2024年3月21日推出,代码为BTRN。

The Bloomberg ETF analyst, James Seyffart, stated in social media that Global X's BTC Futures Strategy ETF will be launched on March 21, 2024 with the code BTRN. & nbsp;

Global X BTC期货策略ETF旨在提供与CoinDesk比特币期货指标期货指数(“基础指数”)的价格和收益率表现(扣除费用和开支)相对应的投资结果。

Global X BTC Futures Strategy ETF aims to provide investment results corresponding to CoinDesk Bitcoin's Futures Indicator (the “base index”) price and yield performance (net of costs and expenses). & nbsp;

据招股说明书,该基金将其总资产的至少80%加上用于投资目的的借款(如有)投资于CoinDesk比特币期货指标期货指数的成分股以及顾问确定具有经济特征的其他证券与构成基础指数的成分股(例如美国上市的比特币期货ETF)的经济特征基本相同。此外,为了追踪相关指数,本基金可能投资于未纳入相关指数的债务证券、现金及现金等价物或货币市场工具,例如回购协议和货币市场基金。

According to the letter of credit, the Fund invests at least 80 per cent of its total assets, together with loans for investment purposes, if any, in the components of the CoinDesk futures index and in other securities identified by the consultants as having economic characteristics similar to the economic characteristics of the components of the underlying index (e.g., the United States-listed Bitcoin futures ETF). In addition, in order to track the index, the Fund may invest in debt securities, cash and cash equivalents or currency market instruments that are not included in the index, such as repurchase agreements and currency market funds.

1.Opensea推出NFT市场协议Seaport 1.6

1. Opensea to launch the NFT market agreement Seaport 1.6

Opensea在X平台发文称,正式推出Seaport1.6 NFT市场协议,Seaport 1.6引入了一项由Ethereum Dencun升级启用的新功能,称为Seaport Hooks。与Uniswap v4 hooks类似,Seaport hooks功能允许开发人员构建扩展NFT实用性和流动性的相关应用。在部分操作中,Seaport 1.6的Gas费比Seaport 1.5便宜5%。

Opensea sent a message on platform X stating that the Seaport 1.6 NFT market agreement was officially launched and that Seaport 1.6 introduced a new feature, called Seaport Hooks, which was upgraded by Etherum Dencun. Similar to Uniswap v4 Hooks, Seaport Hooks allows developers to build applications that extend NFT functionality and mobility. In some operations, Seaport 1.6 Gasfee is 5% less expensive than Seaport 1.5.

2.SLERF创始人:将向受影响的预售者以及退款贡献者发放灵魂绑定NFT

2. SLEF Founder: The affected presales and refund contributors will be given a soul tied NFT

Meme项目SLERF创始人@Slerfsol在X平台发文称,计划将灵魂绑定(Soul-bound)NFT投放到受影响的预售者以及退款贡献者的钱包地址。这将允许其他项目轻松空投代币或NFT,并将此作为SLERF历史中的一份纪念品提供给他们。

The founder of the Meme Project SLERF @Slerfsol wrote on platform X that it was planned to place soul binding NFT at the wallet address of the affected preseller and the refund contributor. This would allow other projects to easily drop tokens or NFTs and provide them with this as a souvenir from SLERF history.

3.贝莱德目前至少持有价值4万美元的MemeCoin和NFT

3.

资产管理巨头贝莱德 (BlackRock) 现在拥有至少价值 40,000 美元的 memecoin 和非同质代币 (NFT),数据显示, 自 3 月 19 日以来,未透露姓名的加密货币用户已向 BlackRock 标签地址发送了至少 40 个代币和 25 个 NFT,从基于比特币的 Ordinals Pepe (PEPE) 代币到 CryptoDickbutts S3 NFT,此外 500,000 枚 unshETHing_Token (USH) 和 10,000 枚 Realio Network (RIO) 代币也被转移到这家价值 10 万亿美元的资产管理公司,贝莱德还收到了大量的 Mog Coin (Mog) VoldemortTrumpRobotnik-10Neko (ETHEREUM) 和 Shina Inu (SHI)。

& nbsp; Since March 19, undisclosed users of encrypted currency have sent at least 40 and 25 NFTs to BlackRock label addresses, from Ordinals Pepe (PEPE) tokens based on Bitcoin to CrystalDickbutts S3 NFTs, in addition to 500,000 unshutHing_Token (USH) and 10,000 Realio Network (RIO) tokens have also been transferred to this $10 trillion asset management company, and a large number of Mog Coin (Mog) Voldemort TrumpRobotnik-10Neko (ETHERUM) and Shinain (SHI) have been received by Beled.

1.Defi综合服务平台OpenStamp获得由Animoca Ventures领投的种子轮融资

1. OpenStamp has received seed rotation financing from Animoca Ventures

基于 STAMP 协议的综合服务平台OpenStamp以 5000 万美元估值完成种子轮融资,Animoca Ventures领投,KuCoin Ventures、MH Ventures、VitalTao Capital、Lotus Capital、Brotherhood Ventures、Blue Node Capital、D64 Ventures、Luminescence Capital、Spicy Capital、Halvings Capital、SPEC Capital和YM Capital也参与其中。OpenStamp提供包括Mint/Deploy服务、SRC-20/SRC-721市场、Indexer、Explorer和Launchpad的各种产品。

OpenStamp, an integrated service platform based on the STAMP agreement, completed seed rotation financing with a US$50 million valuation, with the participation of Animoca Ventures, Kucoin Ventures, MH Ventures, VitalTao Capital, Lotus Capital, Brothhood Ventures, Blue Node Capital, D64 Ventures, Luminescence Capital, Space Capital, Halvings Capital, SPEC Capital and YM Capital.

2.以太坊流动质押协议Lido TVL为343亿美元

2. $34.3 billion from Lido TVL's

The Block数据仪表板,以太坊流动质押协议Lido的总锁定价值 (TVL) 为343亿美元,目前是以太坊上最大的验证者,占质押以太坊总量的30%。

The Block data dashboard, with a total lock value of $34.3 billion (TVL) of Lido, is currently the largest certifier in the district, accounting for 30 per cent of the total number of taupulega.

3.Polygon完成Napoli硬分叉升级,引入RIP-7212提案

3. Polygon completes the Napoli hard fork upgrade and introduces the RIP-7212 proposal

Polygon 宣布完成 Napoli 硬分叉升级,Polygon PoS 成为首个使用 RIP-7212 激活 Rollup 改进提案(RIP)的链,为 secp256r1 曲线提供了新的预编译支持,在与主流技术互操作性方面取得进展。

Polygon announced the completion of the Napoli hard fork upgrade, and Polygon Pos became the first chain to use RIP-7212 to activate the Rollup Improvement Proposal (RIP), providing new pre-revision support for the secp256r1 curve and making progress in interoperability with mainstream technology. & nbsp;

此次升级还与以太坊最近的 Dencun 硬分叉改进保持一致,提高了区块空间效率,限制了自毁操作码范围,并减少了内存复制技术开销。由 RollCall Working Group 开发的 RIP-7212 促进了 L2 解决方案之间的协作性,以巩固以太坊的扩容和创新工作,提升用户体验。

The upgrade is also in line with the recent Ether House improvements in Dencun hard fork, improving block space efficiency, limiting the scope of self-destruct codes, and reducing the cost of memory copying technology. RIP-7212, developed by RollCall Working Group, promotes collaboration between L2 solutions to consolidate Ether’s outreach and innovation efforts and enhance user experience.

4.AirDAO:AMB/ETH Uniswap池中3520万枚AMB和125.51枚ETH被盗

4. AirDAO: 35.2 million AMBs and 125.51 ETHs stolen from AMB/ETH Uniswap

AirDAO发文表示,AMB/ETH Uniswap池中3520万AMB代币和125.51个ETH被盗,正在与交易所和相关部门合作,追回被盗资金。

AirDAO sent a communication stating that 35.2 million AMB tokens and 125.51 ETHs were stolen from AMB/ETH Uniswap and that the stolen funds were being recovered in cooperation with the exchange and relevant authorities. & nbsp;

黑客使用社交工程手法获得了对LP的访问权限,假冒其合作伙伴发送恶意附件的电子邮件。已联系使用过的交易所,跟踪并冻结被盗资金。额外的流动性将尽快添加回uniswap LP,情况已得到缓解。

The additional liquidity will be added to the uniswap LP as soon as possible, and the situation has eased.

5.JUP DAO将注资1000万枚USDC和1亿枚JUP以加速Jupiverse增长

5.JUP DAO will invest 10 million USDCs and 100 million JPs to accelerate Jupiverse growth

据官方公告,JUP DAO下周将正式注资1000万枚USDC(用于运营资金)和1亿枚JUP。资金将被转移到一个单独的DAO钱包中。1000万枚USDC来自收入,1亿枚JUP来自社区分配。这将使DAO能够参与公共物品资助并执行其发展Jupiverse的使命。

According to the official announcement, JUP DAO will officially commit 10 million USDCs (for operating funds) and 100 million JPs next week. The funds will be transferred to a separate DAO wallet. Ten million USDCs will come from revenue and 100 million from community distribution.

6.DeFi Saver推出CurveUSD硬清算保护功能

6. DeFi Saver introduced the CurveUSD hard liquidation protection function

一站式资产管理解决方案DeFi Saver发推称,其已推出CurveUSD硬清算保护功能。官方表示,用户现可以设置一个触发健康比率值(如10%)和从其EOA中自动偿还的crvUSD金额(如10000)。在触发时刻,如果EOA中的crvUSD金额低于配置的还款金额,该策略将使用所有可用的crvUSD来偿还债务。如果没有crvUSD,或如果偿还金额超过gas费成本的50%,则不会执行该策略。目前可用的CurveUSD自动选项包括:自动杠杆管理(自动提升和自动偿还)以及硬清算保护(从钱包自动还款)。

A one-stop asset management solution, DeFi Saver, presumes that it has rolled out the CurveUSD hard liquidation protection. Officially, users can now set up a value triggering health ratios (e.g. 10 per cent) and the amount of crvUSD (e.g. 10,000) that is automatically reimbursed from their EOA. At the trigger, if the crvUSD amount in the EOA is lower than the amount allocated, the strategy will use all available crvUSD to pay the debt. If there is no crvUSD, or if the repayment exceeds 50 per cent of the cost of gas fees, the strategy will not be implemented. Currently available CurveUSD automatic options include: automatic leverage management (automatic upgrade and automatic repayment) and hard liquidation protection (automatic repayment from the wallet).

游戏热点

发表评论